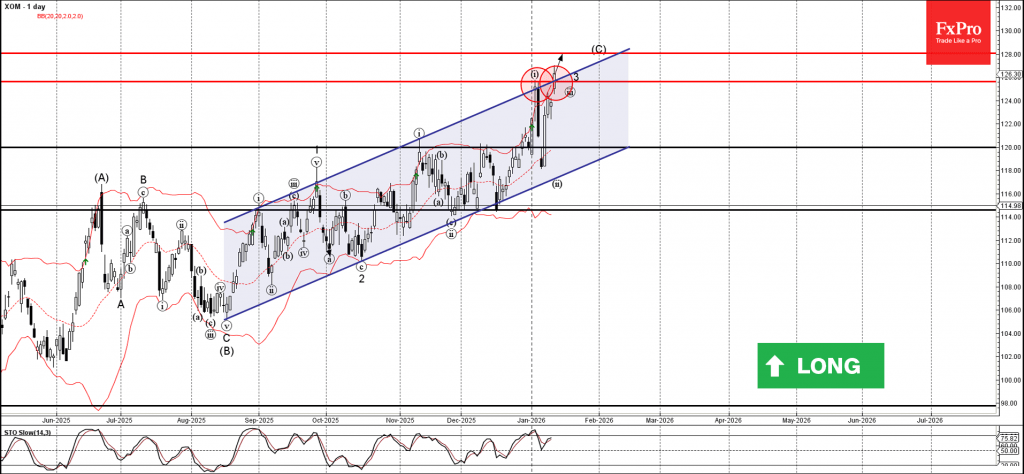

Exxon Mobil ⬆️ Buy

– Exxon Mobil broke resistance level 125.60

– Likely to rise to resistance level 128.00

Exxon Mobil recently broke the resistance area between the key resistance level 125.60 (which stopped the previous impulse wave i) and the resistance trendline of the daily up channel from August.

The breakout of this resistance area accelerated the active impulse wave 3 – which belongs to the intermediate impulse wave (C) from August.

Given the overriding daily uptrend, Exxon Mobil can be expected to rise to the next resistance level 128.00 (target for the completion of the active impulse wave (C)).