– EURUSD reversed from support level 1.1030

– Likely to rise to resistance level 1.1200

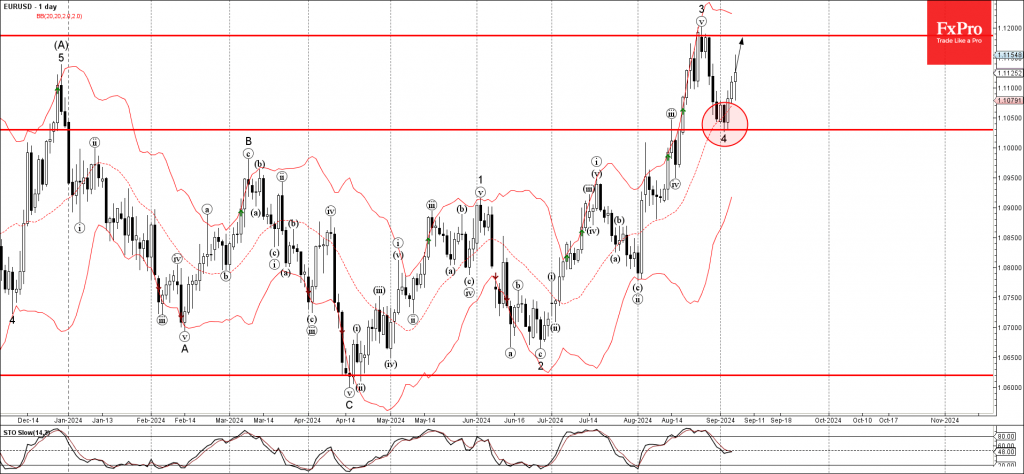

EURUSD recently reversed up from the support level 1.1030 (former resistance from August, acting as the support after it was broken by the previous impulse wave iii).

The upward reversal from the support level 1.1030 created the daily Japanese candlesticks reversal pattern Bullish Engulfing – which started the active impulse wave 5.

Given the bearish US dollar sentiment, EURUSD can be expected to rise further to the next resistance level 1.12000 (which stopped the previous impulse wave 3).