– EURUSD reversed from resistance area

– Likely to fall to support level 1.0800

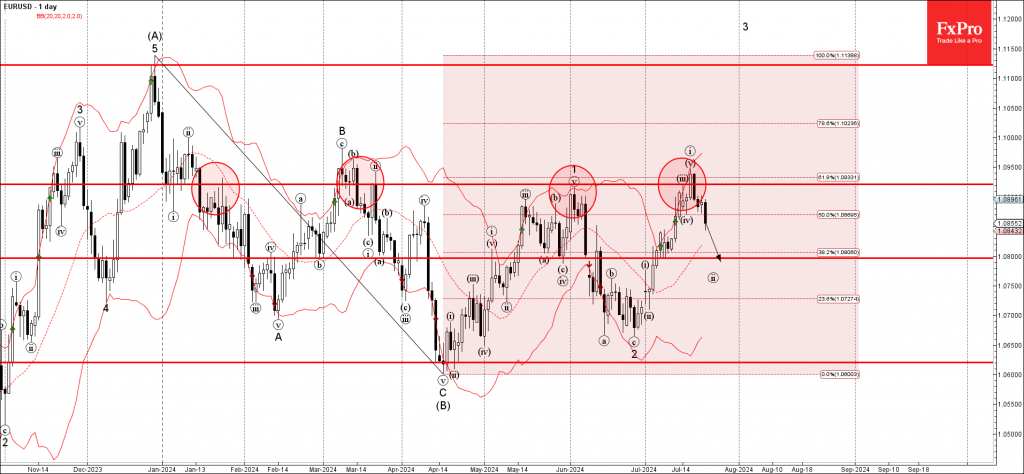

EURUSD currency pair recently reversed down from the resistance area set between the multi-month resistance level 1.0920 (which has been reversing the price from the start of this year), upper daily Bollinger Band and the 61.8% Fibonacci correction of the downward wave B from December.

The downward reversal from this resistance area created the daily Japanese candlesticks reversal pattern Bearish Engulfing – which started the active wave ii.

EURUSD currency pair can be expected to fall further to the next support level 1.0800 (target price for the completion of the active wave ii.