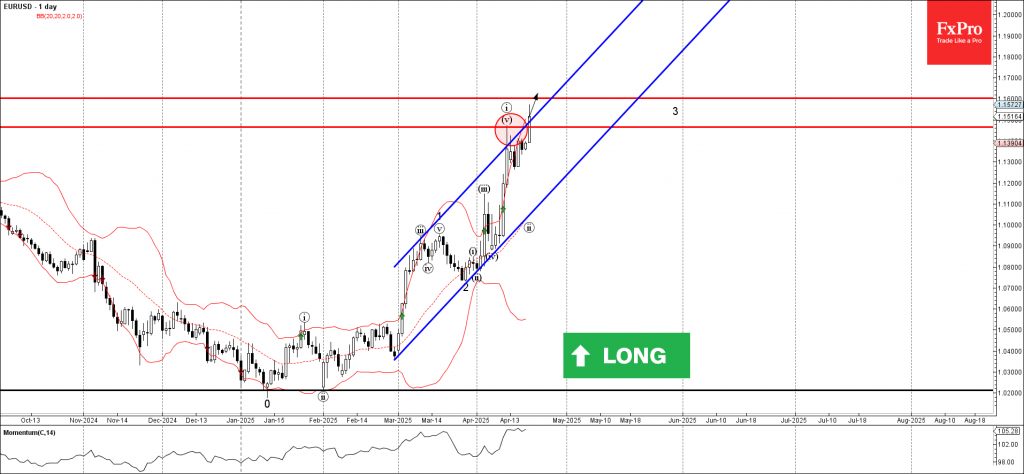

EURUSD: ⬆️ Buy

– EURUSD broke the resistance area

– Likely to test resistance level 1.1600

EURUSD currency pair recently broke the resistance area between the resistance trendline of the daily up channel from the end of February and the resistance level 1.1465 (which stopped the previous impulse wave i).

The breakout of this area accelerated the active short-term impulse wave 3 from the end of March.

Given the moderately bullish euro sentiment, EURUSD currency pair can be expected to rise to the next resistance level 1.1600 (target price for the completion of the active impulse wave 3).