– EURUSD broke resistance area

– Likely to rise to resistance level 1.1135

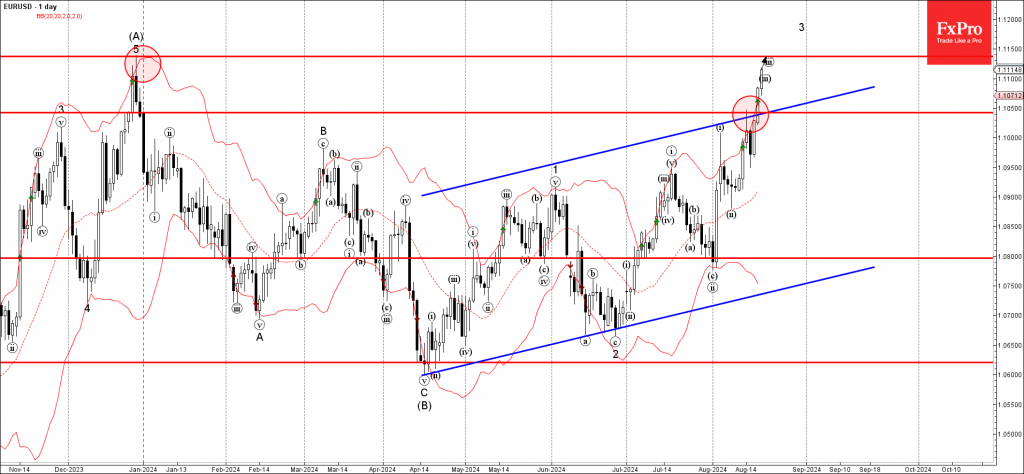

EURUSD currency pair just broke the resistance area located between the resistance level 1.105 (which reversed the price last week) and the resistance trendline of the daily up channel from the middle of April.

The breakout of this resistance area accelerated the active impulse waves iii and 3 – both of which belong to the impulse wave C from April.

Given the strongly bearish US dollar sentiment seen across the FX markets today, EURUSD currency pair can be expected to rise further toward the next resistance level 1.1135 (multi-month high from December) – from where the downward correction is likely.