– EURUSD reversed from long-term support level 1.0500

– Likely to rise to resistance level 1.0620

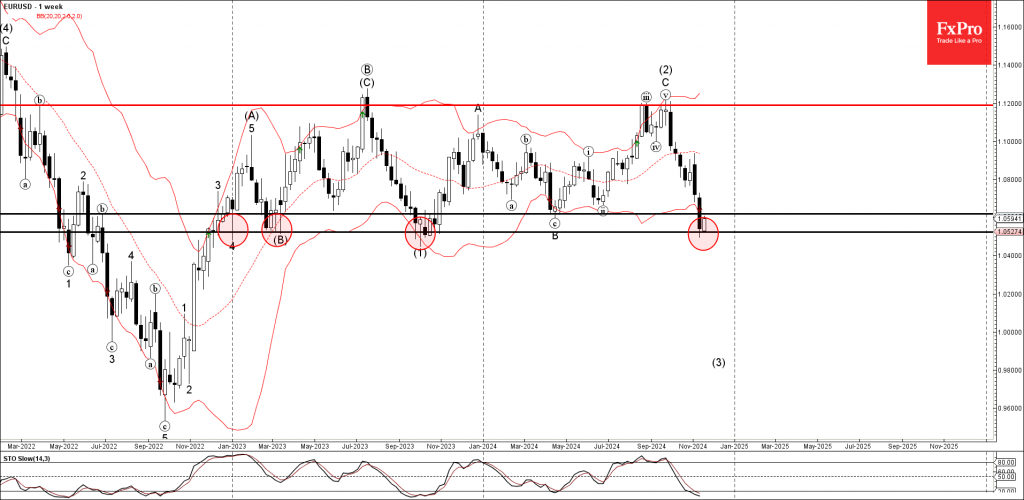

EURUSD currency pair recently reversed up from the major long-term support level 1.0500 (which has been steadily reversing the price from the start of 2023, as can be seen below), standing close to the lower daily Bollinger Band.

The support level 1.0500 level was further strengthened by the lower daily Bollinger Band.

Given the strength of the support level 1.0500, oversold weekly Stochastic and the strong US dollar bearishness seen today, EURUSD currency pair can be expected to rise to the next resistance level 1.06200, former support from the start of this year.