– EURUSD reversed from key support level 1.0665

– Likely to rise to resistance level 1.0800

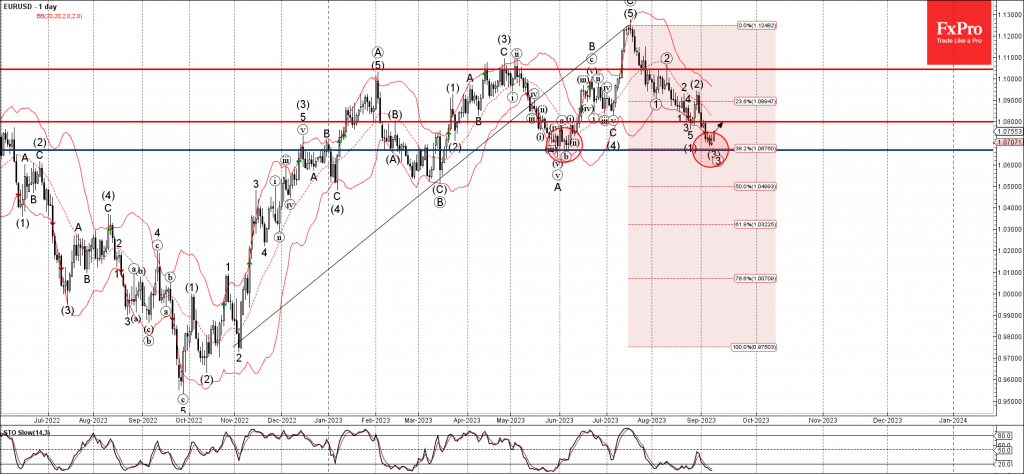

EURUSD currency pair recently reversed up from the key support level 1.0665 (former strong support from April and May), intersecting with the lower daily Bollinger Band and the 38.2% Fibonacci correction of the upward impulse from November of 2022.

The upward reversal from the support level 1.0665 stopped the previous short-term impulse wave 3.

Given the oversold daily Stochastic and the strong USD sales seen across the FX markets today, EURUSD can be expected to rise further toward the next resistance level 1.0800 (former low of wave 3 from the end of last month).