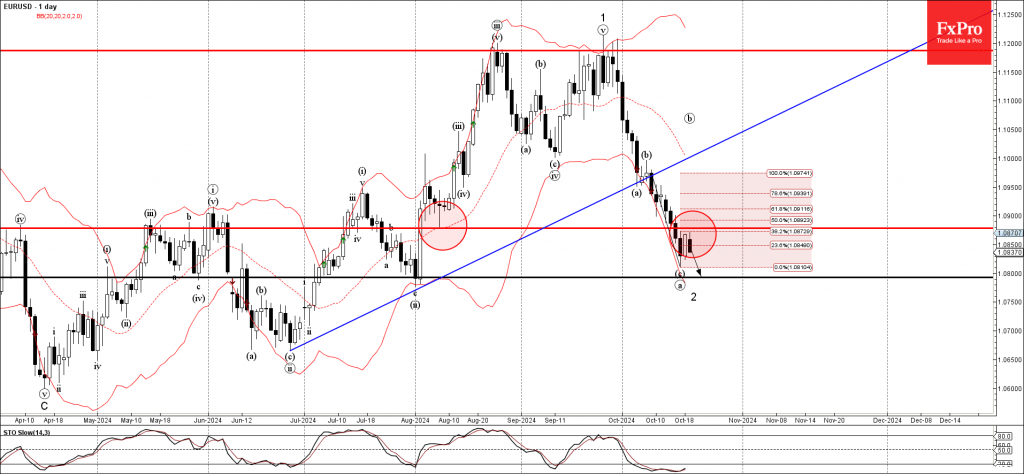

– EURSUD reversed from resistance level 1.0875

– Likely to fall to support level 1.0800

EURSUD currency pair recently reversed down from the key resistance level 1.0875 (former support from the start of August) standing near the 38.2% Fibonacci correction of the downward impulse from the start of this month.

The downward reversal from the resistance level 1.0875 continues the active short-term ABC correction 2 from the end of September.

Given the strongly bullish US dollar sentiment seen across the FX markets today, EURSUD currency pair can be expected to fall further to the next support level 1.0800, former strong support from July.