• EURNZD broke resistance level 1.7550

• Likely to rise to resistance level 1.7800

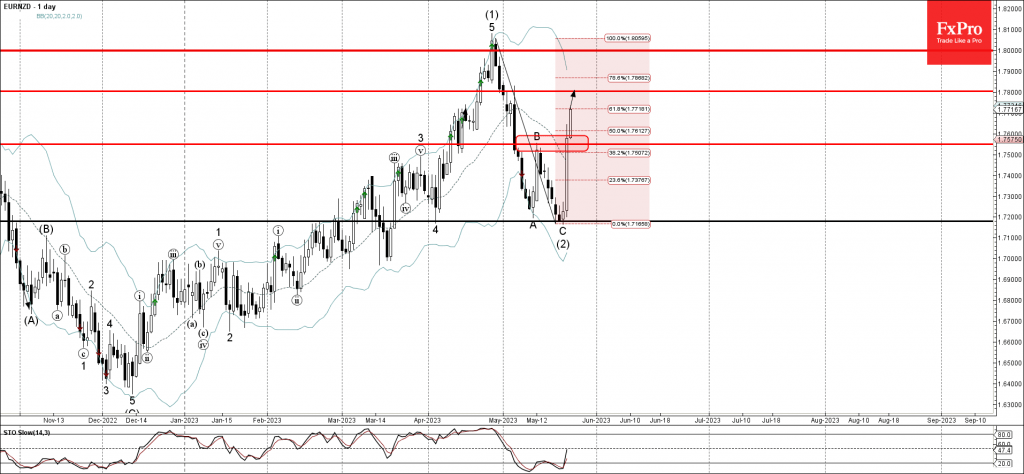

EURNZD continues to rise after the earlier breakout of the resistance level 1.7550 (top of the previous correction B), intersecting with the 38.2% Fibonacci correction of the ABC correction (2) from April).

The breakout of the resistance level l 1.7550 accelerated the active intermediate impulse wave (3).

Given the overriding daily uptrend, EURNZD can be expected to rise further toward the next resistance level 1.7800.