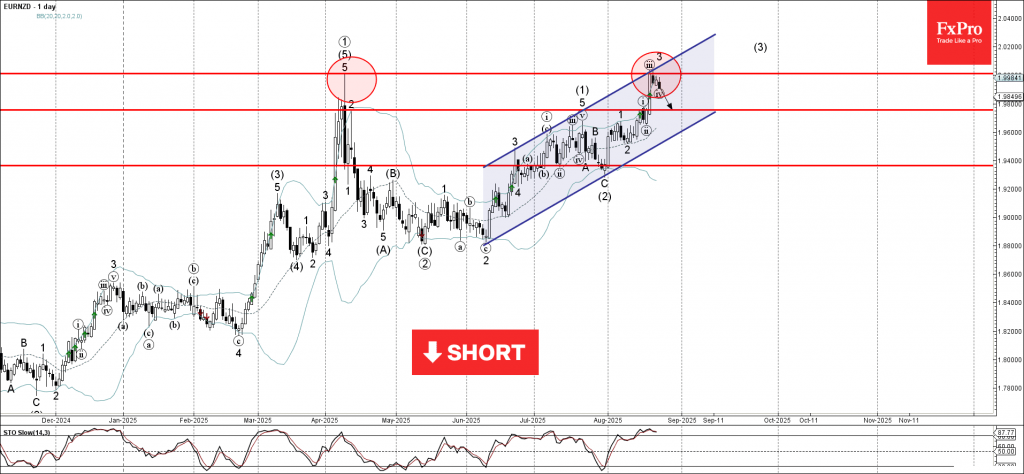

EURNZD: ⬇️ Sell

– EURNZD reversed from the round resistance level 2.0000

– Likely to fall to support level 1.9800

EURNZD currency pair recently reversed from the resistance area between the round resistance level 2.0000 (former multi-month high from April) and the upper daily Bollinger Band.

This resistance area was further strengthened by the upper resistance trendline of the daily up channel from the start of June.

Given the strength of the resistance level 2.0000 and the overbought daily Stochastic, EURNZD currency pair can be expected to fall to the next support level 1.9800.