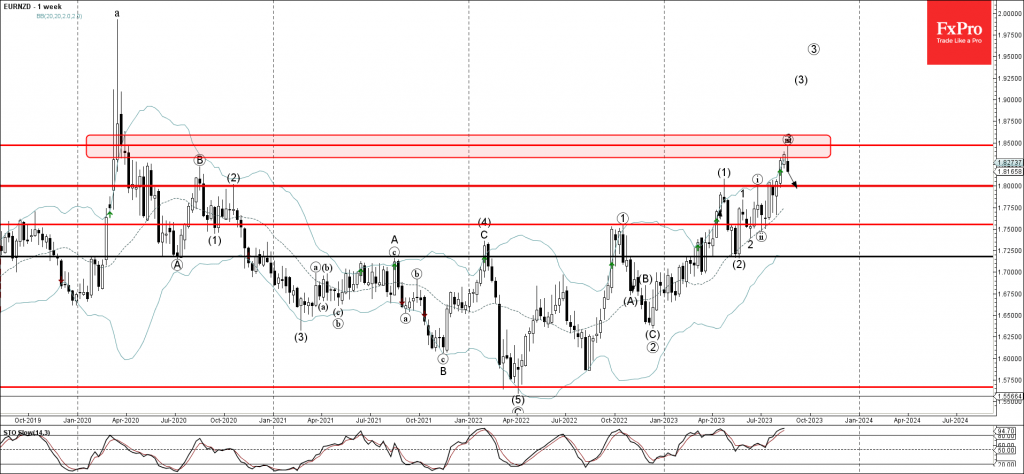

– EURNZD reversed from resistance level 1.8500

– Likely to fall to support level 1.8000.

EURNZD recently reversed down from the key resistance level 1.8500 standing well above with the upper weekly and the daily Bollinger Bands.

The downward reversal from the support level 1.8500 stopped the earlier intermediate impulse wave (3) from June.

Given the strength of the resistance level 1.8500 and the overbought weekly Stochastic, EURNZD can be expected to fall further toward the next round support level 1.8000.