– EURJPY reversed from resistance level 159.50

– Likely to fall to support level 156.95

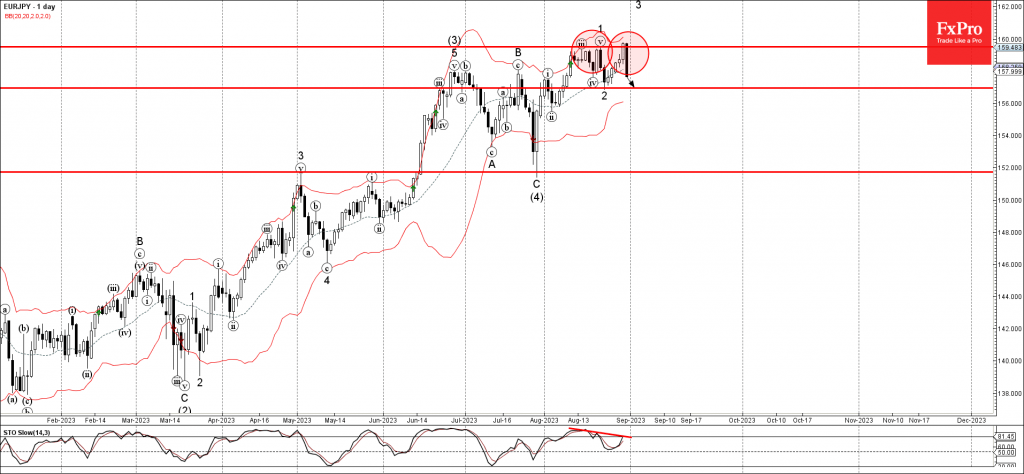

EURJPY currency pair recently reversed down from the key resistance level 159.50 (top of the previous minor impulse wave 1) intersecting with the upper daily Bollinger Band.

The downward reversal from the resistance level 159.50 is likely to form the daily Japanese candlesticks reversal pattern Bearish Engulfing.

Given the clear bearish divergence on the daily Stochastic indicator, EURJPY currency pair can be expected to fall further toward the next support level 156.95 (low of the previous wave 2).