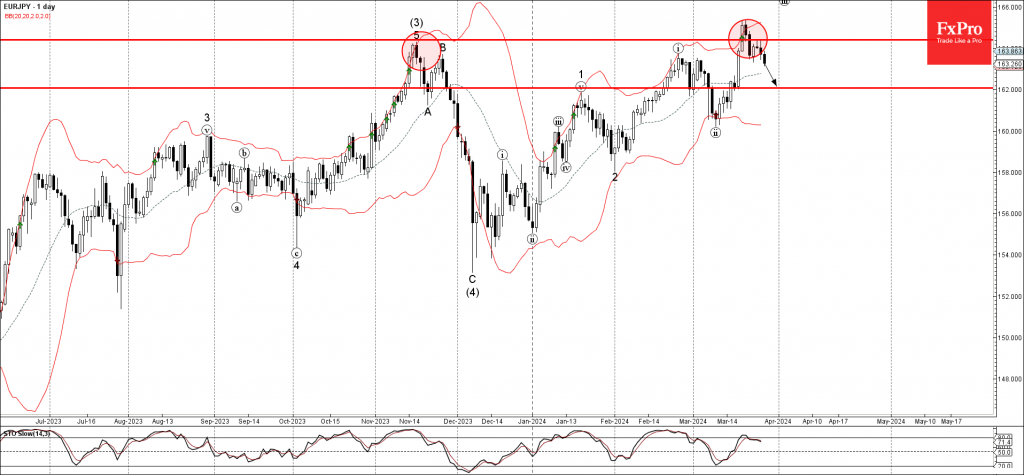

– EURJPY reversed from key resistance level 164.40

– Likely to fall to support level 162.00

EURJPY currency pair recently reversed down after the price failed to hold the ground above the key resistance level 164.40 (which stopped the sharp uptrend in last November), standing close to the upper daily Bollinger Band.

The downward reversal from the resistance level 164.40 created the daily Japanese candlesticks reversal pattern Evening Star Doji.

Given the strength of the resistance level 164.40 and the bullish yen sentiment, EURJPY currency pair can be expected to fall further to the next support level 162.00.