- EURJPY reversed from the support zone

- Likely to rise to the resistance level 158.00

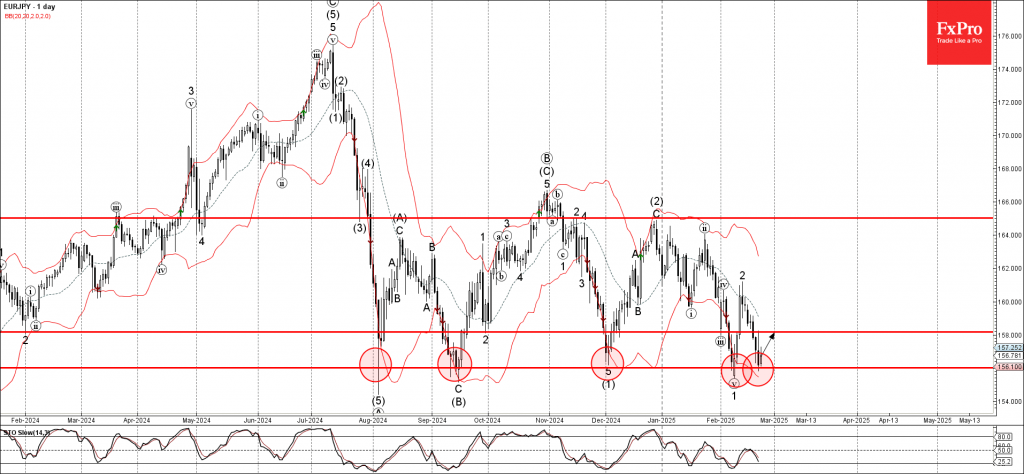

EURJPY currency pair recently reversed up from the support zone between the multi-month support level 156.00 (which has been reversing the pair from last August) and the lower daily Bollinger Band.

The upward reversal from this support zone is likely to form the daily Japanese candlesticks reversal pattern Piercing Line – if the pair closes today near the current levels.

Given the strength of the support level 156.00 and the bullish euro sentiment seen today, EURJPY currency pair can be expected to rise to the next resistance level 158.00.