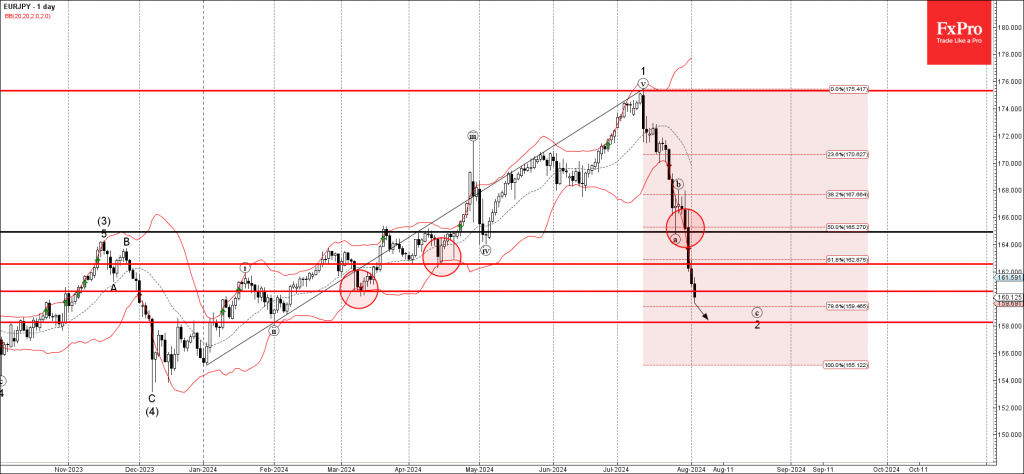

– EURJPY falling inside accelerated impulse wave c

– Likely to test support level 158.00

EURJPY currency pair continues to fall inside the accelerated downward impulse wave c of the minor ABC correction 2 from the start of July.

The price earlier broke the support zone lying between the support level 162.50 (former monthly low from March) and the 61.8% Fibonacci correction of the upward impulse from January.

Given the strongly bearish yen sentiment seen across the FX markets, EURJPY currency pair can be expected to fall further toward the next support level 158.00 (target price for the completion of the active impulse wave c).