– EURJPY reversed from support area

– Likely to rise to resistance level 172.95

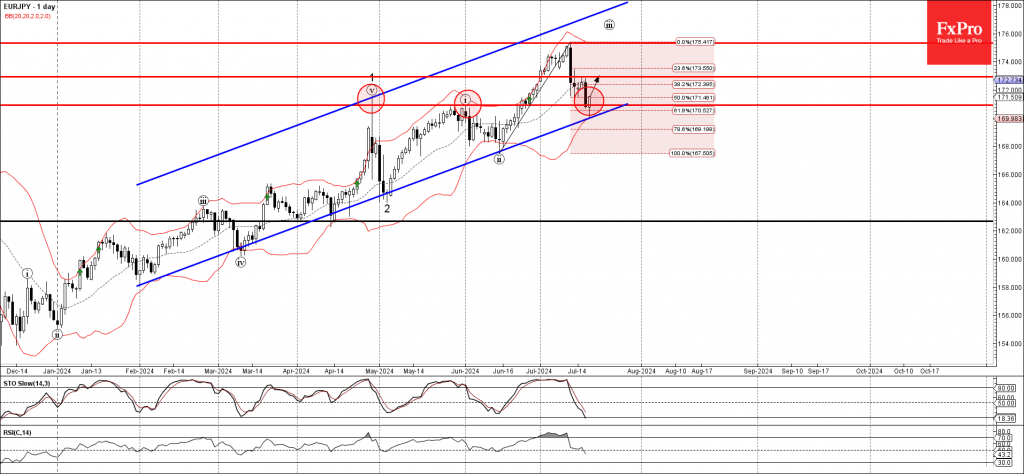

EURJPY currency pair today reversed up from the support area located between the pivotal support level 170.95 (which stopped the pair in April and May), lower daily Bollinger Band, 50% Fibonacci correction of the upward impulse from June and the support trendline of the daily up channel from February.

The upward reversal from this support area stopped the previous short-term correction from the start of July.

Given the clear daily uptrend and the oversold daily Stochastic, EURJPY currency pair can be expected to rise further to the next resistance level 172.95.