– EURJPY reversed from the resistance zone

– Likely to fall to support level 160.90

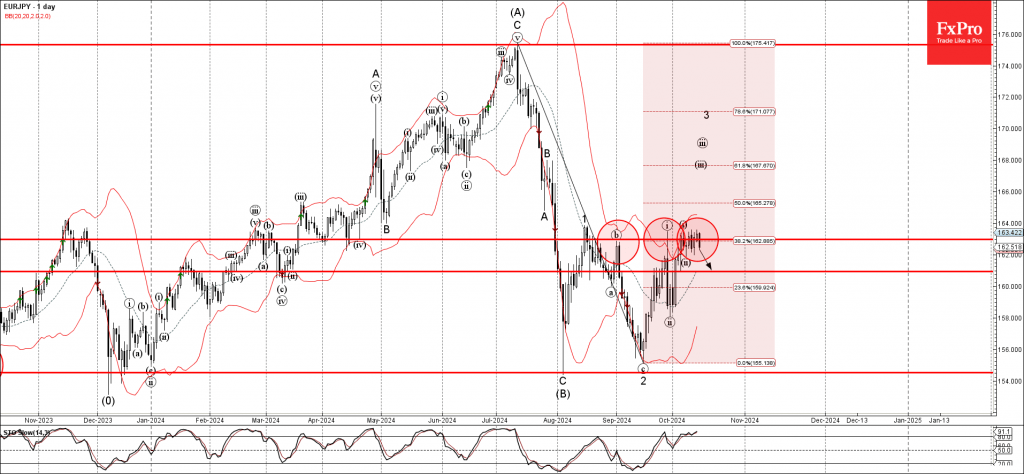

EURJPY currency pair recently reversed down from the resistance zone located between the key resistance level 163.00 (which has been reversing the price from the end of September), the upper daily Bollinger Band and the 38.2% Fibonacci correction of the downward impulse from July.

The downward reversal from this resistance zone stopped the earlier short-term impulse waves iii, 3 – which belong to the impulse wave (C) from August.

Given the overbought daily Stochastic, EURJPY can be expected to fall further to the next support level 160.90 (former minor support from the start of October).