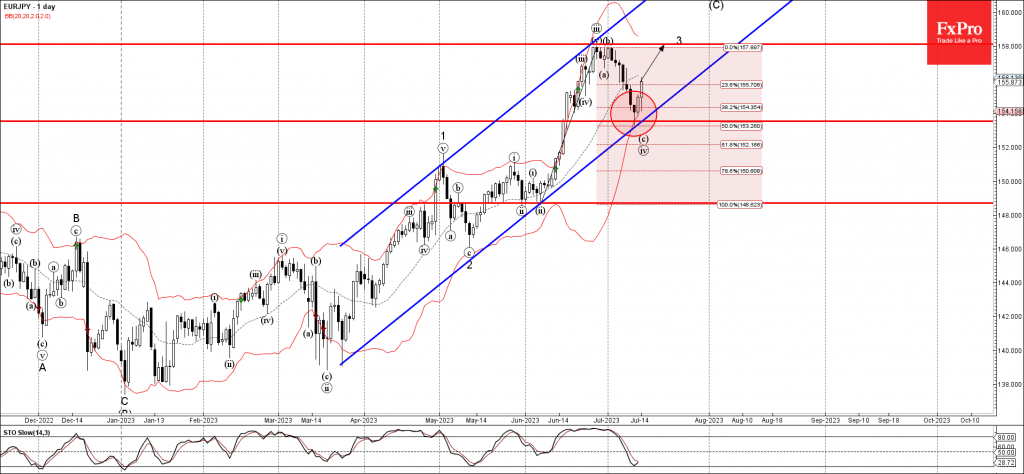

– EURJPY reversed from support level 153.50

– Likely to rise to resistance level 158.00

EURJPY currency pair recently reversed up sharply from the support level 153.50, intersecting with the daily up channel from March, lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse from last month.

The upward reversal from the support level 153.50 continues the active short-term impulse wave 3 from May.

Given the clear daily uptrend, EURJPY can be expected to rise further toward the next resistance level 158.00 (target price for the completion of the active impulse wave 3).