– EURGBP reversed from multi-month support level 0,8500

– Likely to rise to resistance level 0.8565

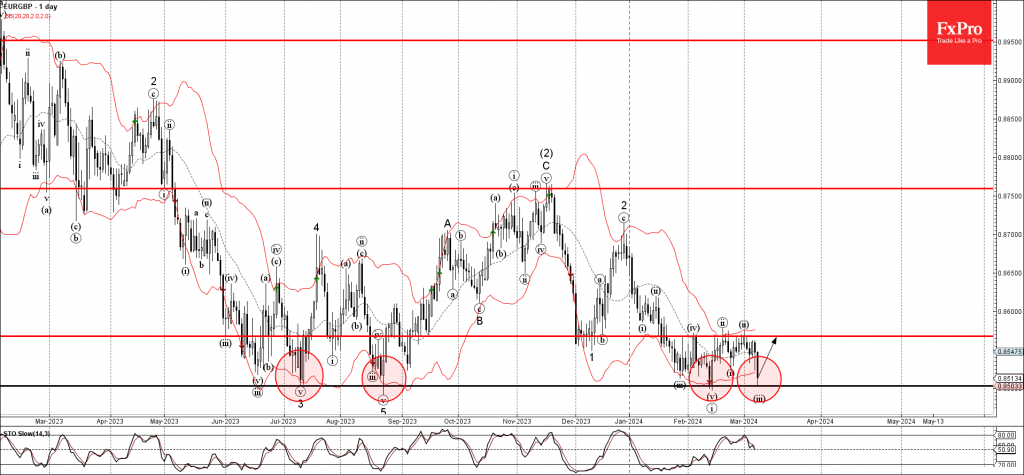

EURGBP currency pair today reversed up from the major multi-month support level 0,8500 (which has been repeatedly reversing the pair from last July, as can be seen below).

The support level 0,8500 was further strengthened by the lower daily Bollinger Band.

Given the strength of the support level 0,8500 and the clear bullish divergence on the daily Stochastic indicator, EURGBP currency pair can be expected to rise further toward the next resistance level 0.8565, which stopped the earlier minor corrections iv, ii and ii.