– EURGBP reversed from support zone

– Likely to rise to resistance level 0.8375

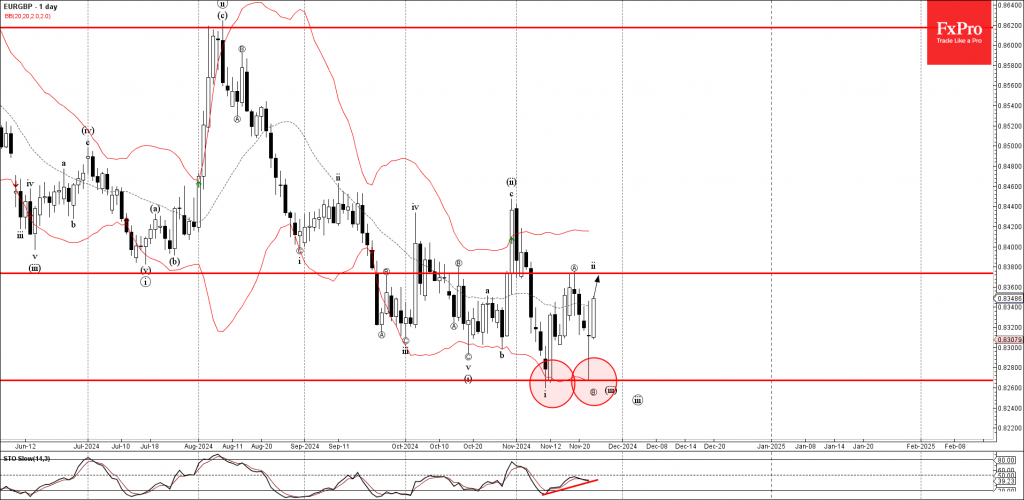

EURGBP currency pair previously reversed up from the support area located at the intersection of the support level 0.8260 (which stopped the previous minor impulse wave i) and the lower daily Bollinger Band.

The upward reversal from this support zone created the daily Japanese candlesticks reversal pattern Long Legged Doji – strong buy signal for this currency pair.

Given the bullish divergence on the daily Stochastic indicator, EURGBP currency pair can be expected to rise further to the next resistance level 0.8375 (top of the previous minor correction a).