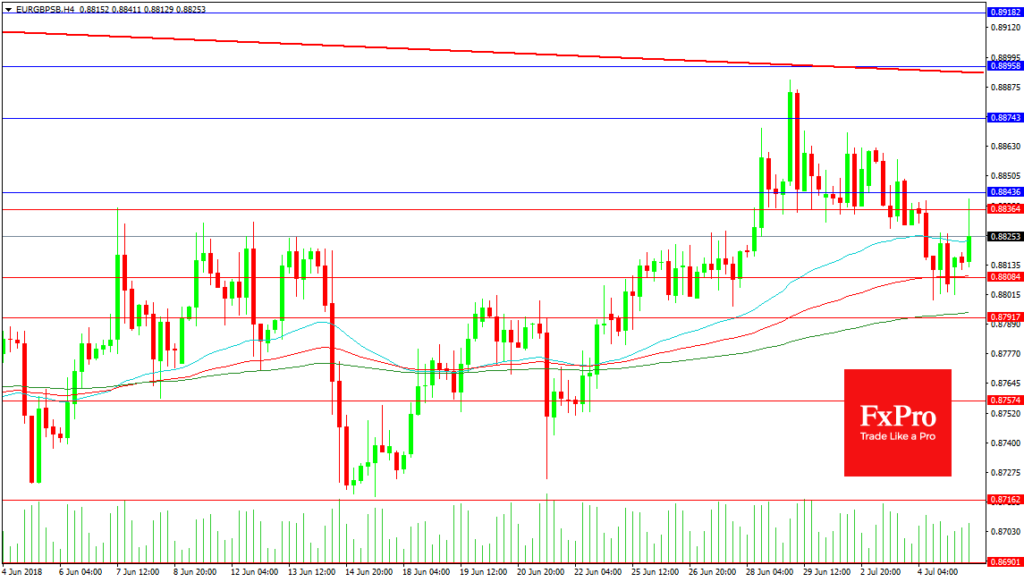

The EURGBP is trading at its 50 period MA in a 4 hour time frame at 0.88235 after it reversed its fall from yesterday this morning to reach 0.88411. This was on the back of reports that some members of the ECB are of the opinion that hiking in the autumn of 2019 will be too late. Resistance comes in at 0.88436 above today’s high forming an area that was first tested early in June and was used as support and resistance as June turned to July. A break above this area would target the highs at 0.88743 followed by 0.88920. The falling trend line at 0.88900 is longer timeframe resistance giving strength to the 0.89000 level.

The fall yesterday was triggered by a reaction to stronger UK Retail Sales, and better economic data from the UK will add strength to the GBP, with price in the pair pushing lower towards yesterday’s lows and the 200 period MA at 0.87938. A break under this level and the 0.88000 area can see a drop towards 0.87574 followed by 0.87162 and the 0.86900 area.