– EURCHF reversed from support level 0.9750

– Likely to rise to resistance level 0.9845 and 1

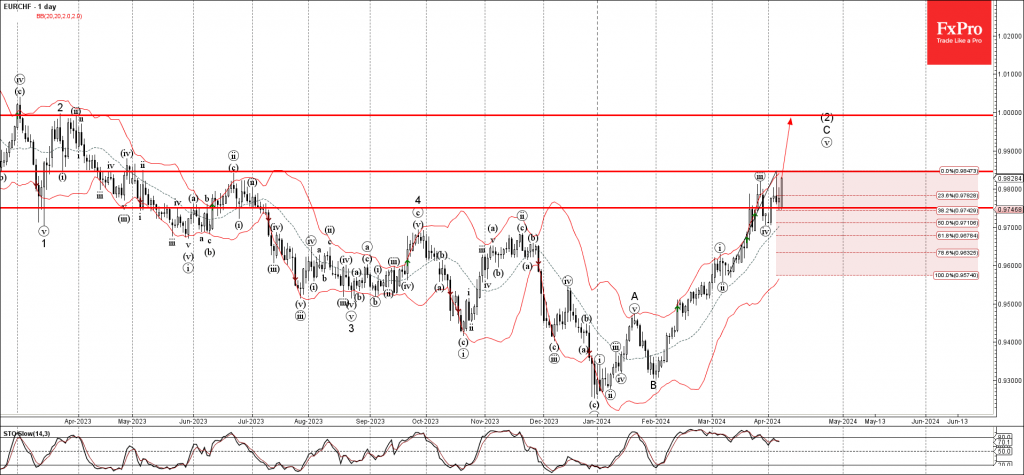

EURCHF rising after the recent upward reversal from the support level 0.9750 intersecting with the 38.2% Fibonacci correction of the upward impulse from the start of March.

The upward reversal from this support level 0.9750 continues the C-wave of the active intermediate ABC correction (2) from January.

Given the string Swiss franc sales, EURCHF can be expected to rise further to the next resistance level 0.9845 (multi month high from June) – followed by parity (target for the completion of the active impulse wave C).