– EURCHF broke resistance level 0.9530

– Likely to rise to resistance level 0.9615

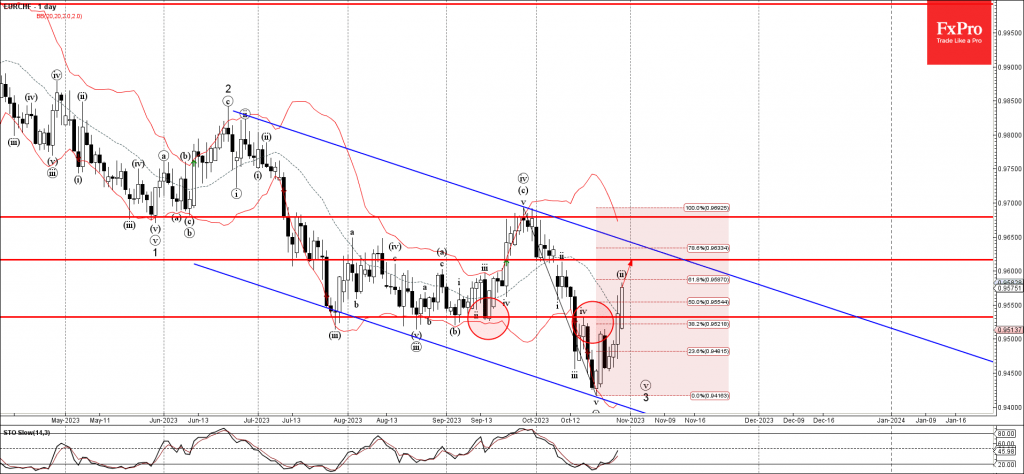

EURCHF recently broke the resistance level 0.9530 (top of the previous minor correction iv) coinciding with the 38.2% Fibonacci correction of the previous downward impulse v from September.

The breakout of the resistance level 0.9530 accelerated the active short-term ABC correction ii.

Given the widespread bearish Swiss franc sentiment, EURCHF can be expected to rise further toward the next resistance level 0.9615 (top of the previous minor wave ii).