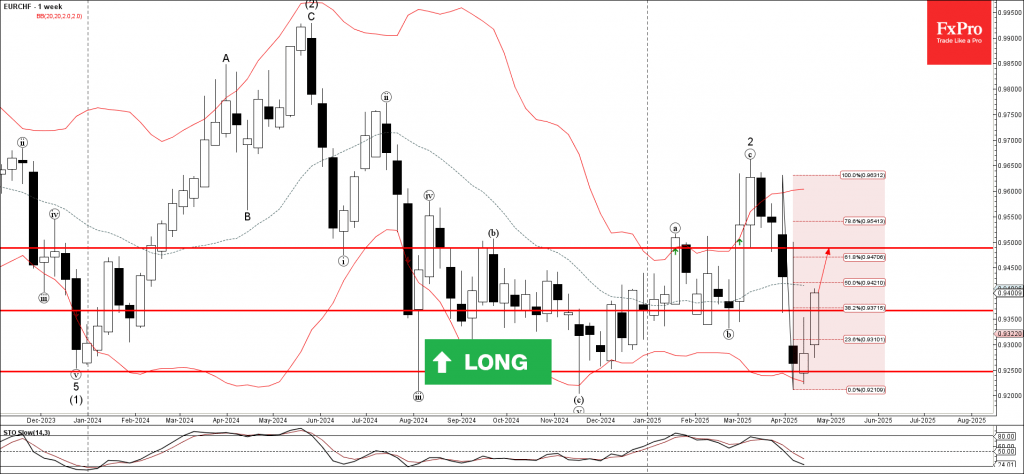

EURCHF: ⬆️ Buy

– EURCHF broke the resistance area

– Likely to rise to resistance level 0.9500

EURCHF currency pair recently broke the resistance area between the resistance level 0.9365 (former strong support from the start of 2025) and the 38.2% Fibonacci correction of the downward impulse from March.

The breakout of this resistance area should accelerate the active upward correction which started earlier from the major support level 0.9250.

Given the strength of the support level 0.9250 and the strong outflows from the Swiss franc, EURCHF currency pair can be expected to rise toward the next resistance level 0.9500.