– EURCAD broke multi-year resistance 1.5100

– Likely to rise to resistance level 1.5770

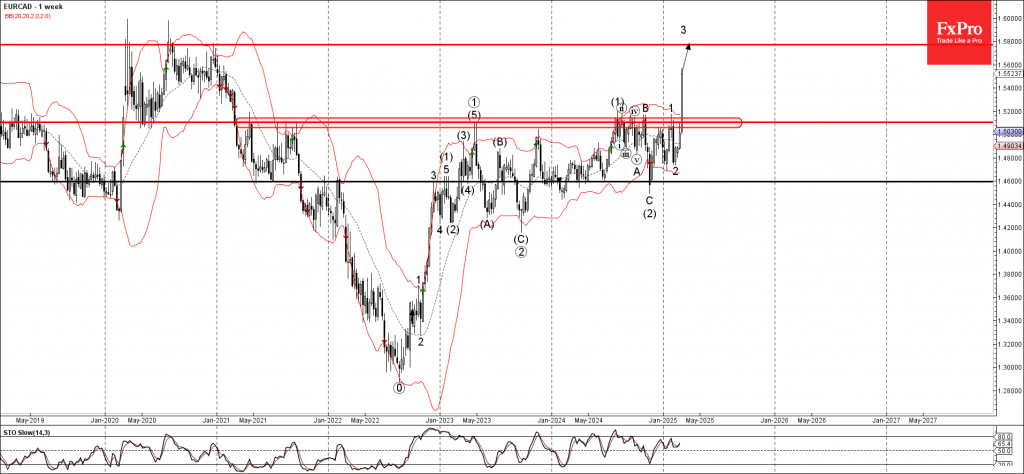

EURCAD currency pair is rising sharply after the earlier breakout of the powerful multi-year resistance 1.5100, which has stopped all upward impulses from the start of 2021.

The breakout of the resistance 1.5100 accelerated the short-term impulse wave 3 of the longer-term upward impulse sequence (3) from the end of 2024.

Given the clear multiyear uptrend, EURCAD currency pair can be expected to rise to the next resistance level 1.5770, the former major price barrier from 2020 and the target for the completion of the active weekly impulse wave 3.