– EURCAD broke resistance level 1.5085

– Likely to rise to resistance level 1.5175

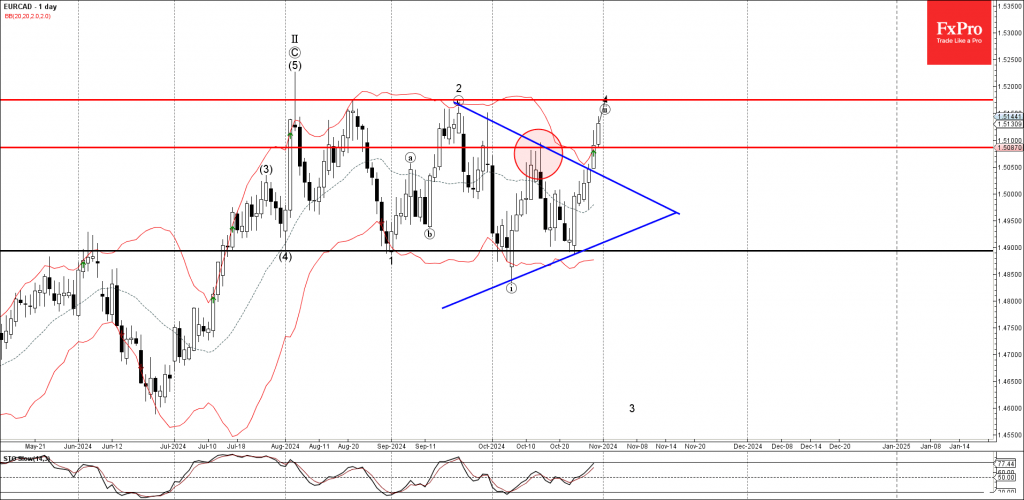

EURCAD currency pair recently broke the resistance level 1.5085 (which reversed the price in the middle of October).

The breakout of the resistance level 1.5085 was preceded by the breakout of the daily Triangle from September – which accelerated the active wave ii.

Given the continuation of the bearish Canadian dollar sentiment, EURCAD currency pair can be expected to rise to the next resistance level 1.5175 (the former monthly high from September and the target for the completion of the active wave ii).