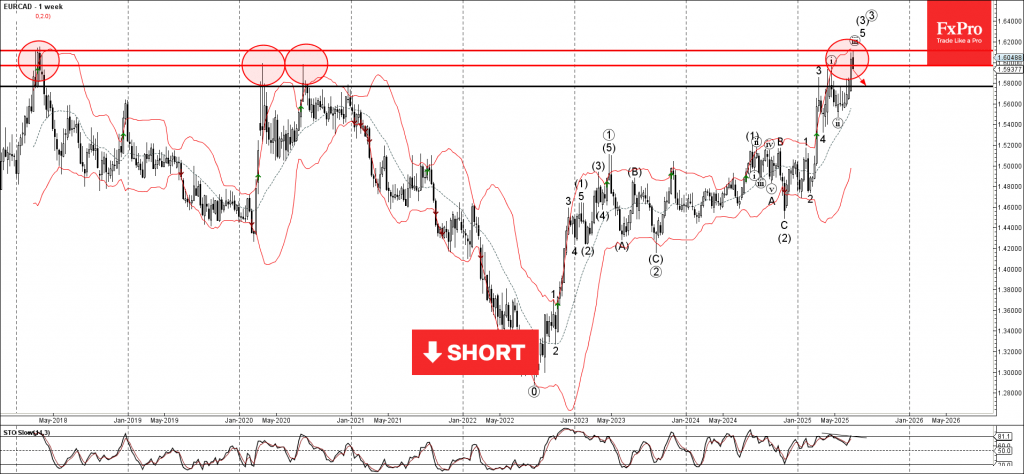

EURCAD: ⬇️ Sell

– EURCAD reversed from resistance zone

– Likely to fall to support level 1.5800

EURCAD currency pair recently reversed down from the major resistance zone located between the strong resistance level 1.6150 (former yearly high from 2018) and the resistance level 1.5965 (former Double Top from 2020).

The downward reversal from this resistance zone stopped the previous impulse waves 5 and (3).

Given the strength of the resistance level 1.6150 and the bearish divergence on the weekly Stochastic indicator, EURCAD currency pair can be expected to fall further to the next support level 1.5800.