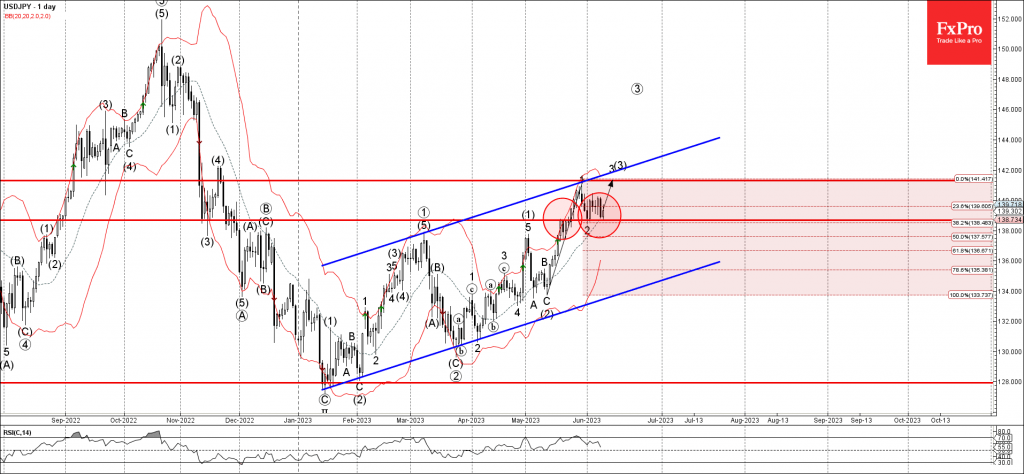

– USDJPY reversed from support level 138.70.

– Likely to rise to resistance level 141.30

USDJPY recently reversed up from the 138.70 support (which stopped the previous correction 2 in early June).

Support at 138.70 was strengthened by the 20-day MA and by 38.2% Fibonacci retracement of the sharp upside impulse 1 from early May.

Given the prevailing daily uptrend, we can expect USDJPY to rise further towards the next resistance level at 141.30 (top of the impulse wave 1 from the end of May).