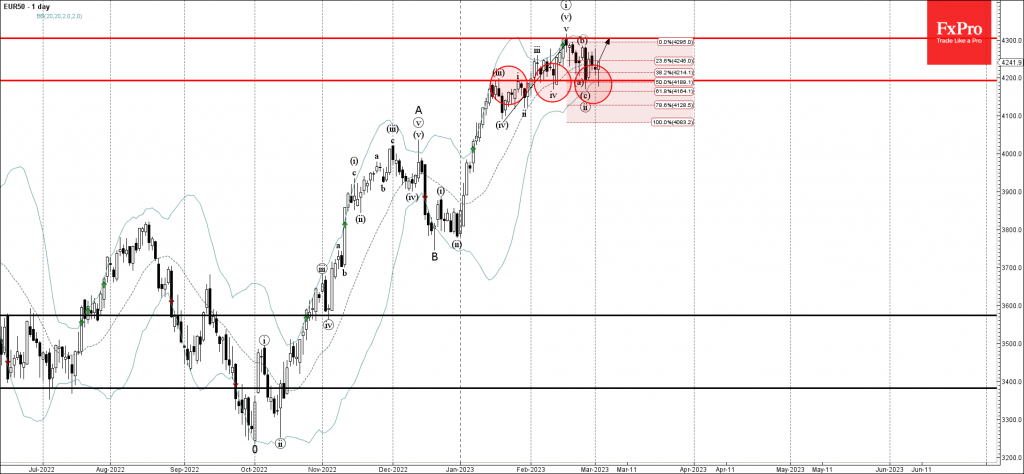

• EUR50 reversed from support level 4200.00

• Likely to rise to resistance levels 4300.00

EUR50 index previously reversed up from the support level 4200.00 (former resistance from January) intersecting with the lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse from January.

The upward reversal from the support level 4200.00 is likely to form the daily Hammer today – strong buy signal for this index.

Given the overriding uptrend, EUR50 index can be expected to rise further toward the next resistance level 4300.00 (top of the previous impulse wave (v)).