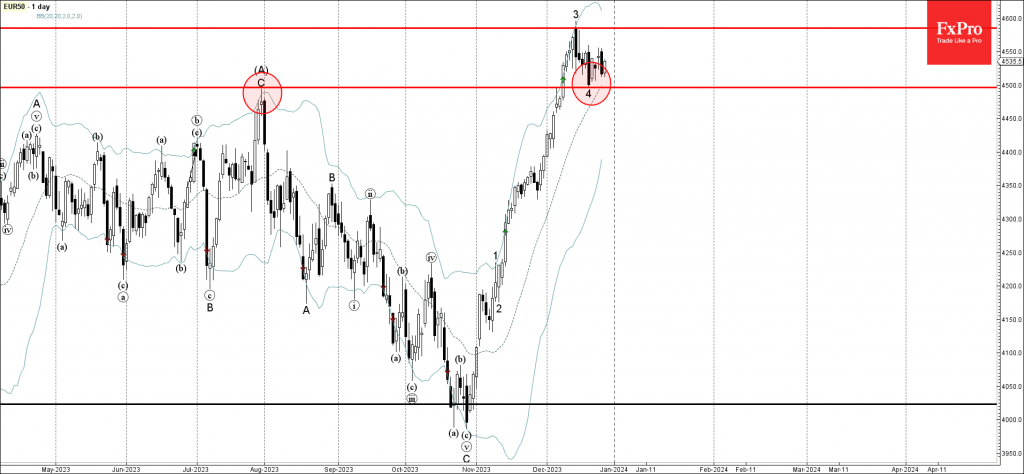

– EUR50 index reversed from support level 4500.00

– Likely to rise to resistance level 4585.00

EUR50 index recently reversed up from the key support level 4500.00 (former multi-month high from July, acting as support after it was broken earlier).

The upward reversal from the support level 4500.00 started the active minor impulse wave 5 of the intermediate impulse wave (C) from the end of October.

Given the clear daily uptrend, EUR50 index can be expected to rise further to the next resistance level 4585.00 (top of the previous impulse wave 3).