– EUR50 reversed from support level 4230.00

– Likely to rise to resistance level 4400.00

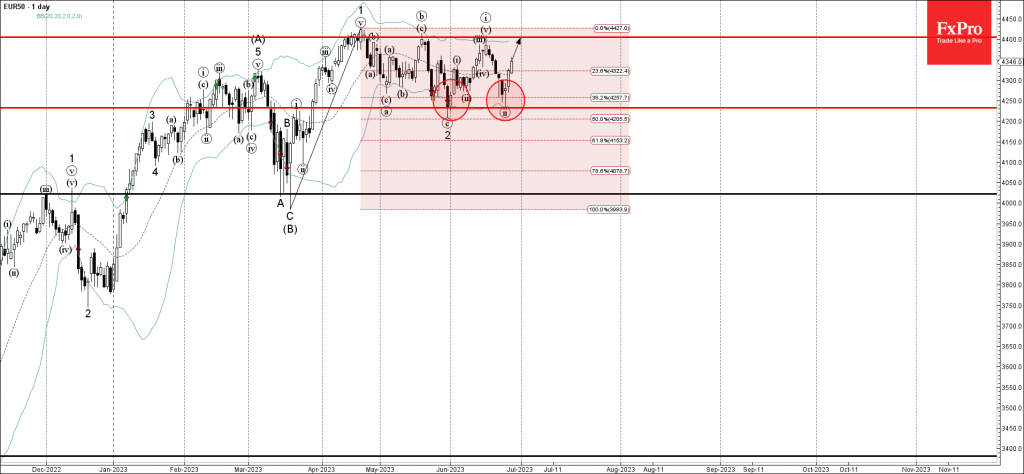

EUR50 index recently reversed up from the key support level 4230.00 (low of the previous correction 2) standing near the 38.2% Fibonacci correction of the upward impulse 1 from March.

The upward reversal from the support level 4330.00 created the daily Japanese candlesticks reversal pattern Hammer, which stopped the previous short-term corrective wave (ii).

Given the clear daily uptrend, EUR50 index can be expected to rise further toward the next resistance level 4400.00 (which stopped the previous waves 1, (b) and (i)).