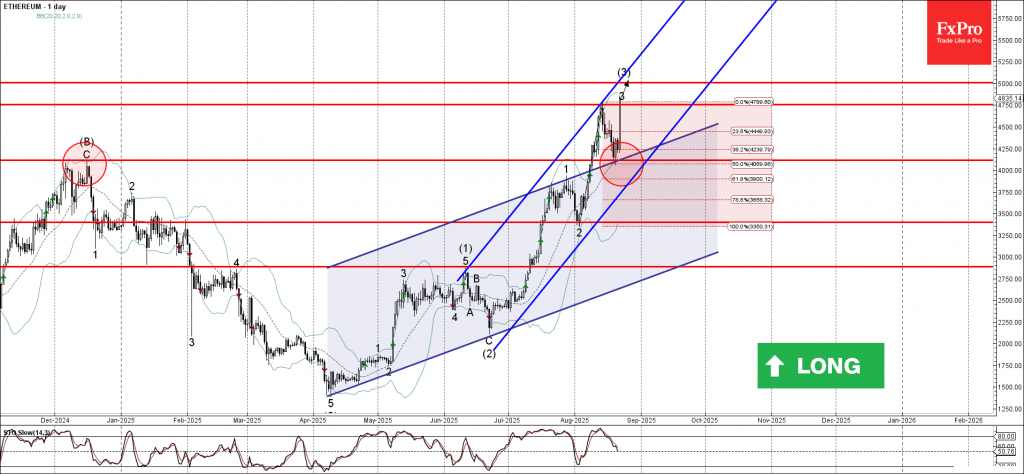

Ethereum: ⬆️ Buy

– Ethereum broke above the resistance level 4750.00

– Likely to rise to resistance level 5000.00

Ethereum cryptocurrency recently reversed up from the support area between the support level 4115.00 (former multi-month high from December), upper trendline of the recently broken up channel from June and the 50% Fibonacci correction of the upward impulse from the start of August.

The upward reversal from this support area accelerated the active impulse wave 3 of the higher order impulse wave (3) from June.

Having just broke above the resistance level 4750.00, Ethereum cryptocurrency can be expected to rise to the next round resistance level 5000.00 (target for the completion of the active impulse wave 3).