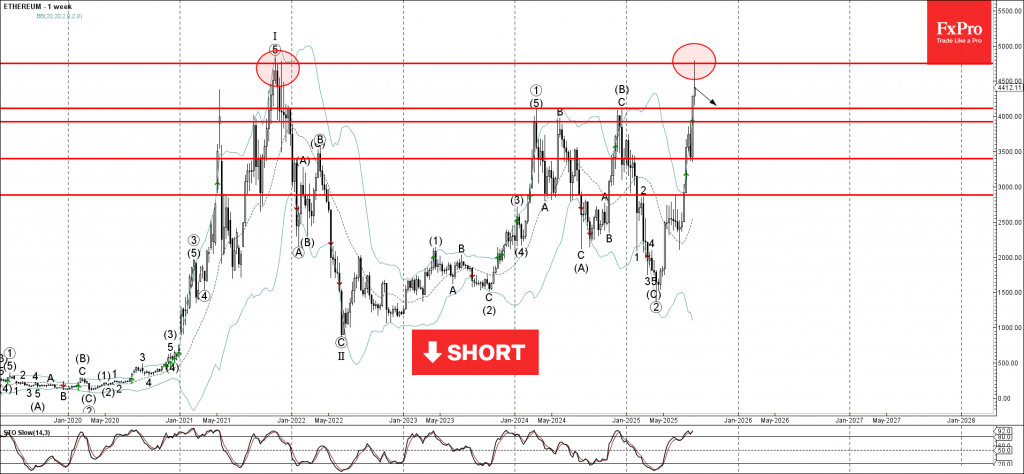

Ethereum: ⬇️ Sell

– Ethereum reversed from the long-term resistance level 4755.

– Likely to fall to support level 4115.00

Ethereum cryptocurrency recently reversed from the major long-term resistance level 4755.00 (which stopped the earlier sharp weekly uptrend at the end of 2021).

The downward reversal from the resistance level 4755.00 stopped the previous sharp weekly upward impulse sequence 1 from the start of this year.

Given the strength of the resistance level 4755.00 and the still overbought weekly Stochastic, Ethereum cryptocurrency can be expected to fall to the next support level 4115.00 (former yearly top from 2024).