– Dow Jones reversed from resistance area

– Likely to fall to support level 44300.00

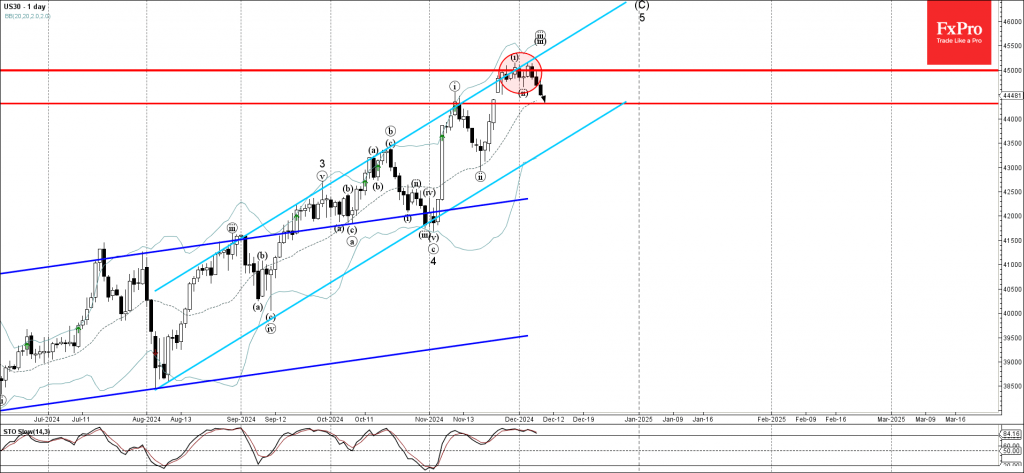

Dow Jones index previously reversed down from the resistance area between the resistance level 45000.00 (which has been reversing the index from the end of November), resistance trendline of the daily up channel from August and the upper daily Bollinger Band.

The downward reversal from this resistance zone started the active minor correction iv of the higher impulse wave 5 from last month.

Given the overbought daily Stochastic, Dow Jones index can be expected to fall toward the next support level 44300.00 (former resistance which stopped wave i at the start of November).