– Dow Jones reversed from support level 42000.00

– Likely to rise to resistance level 43000.00

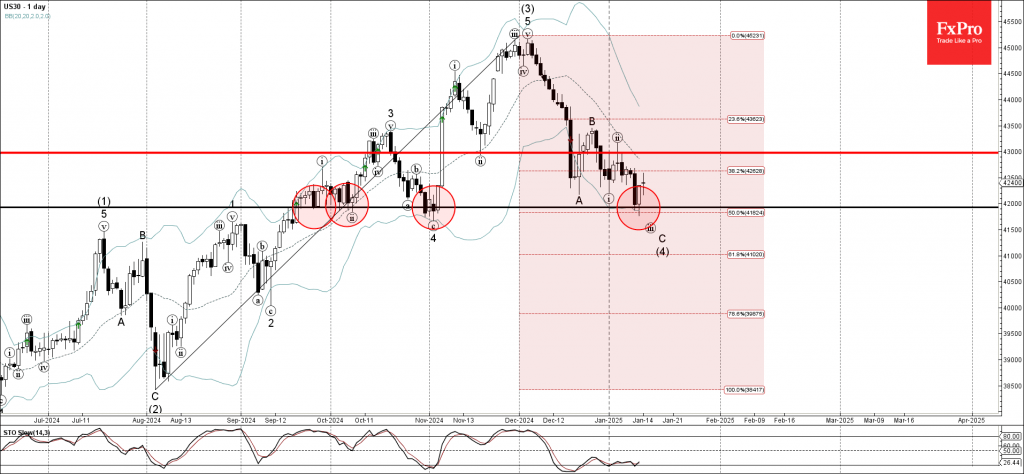

Dow Jones index recently reversed up with the daily Piercing Line reversal pattern from the pivotal support level 42000.00, which has been reversing the price from September.

The support level 42000.00 was strengthened by the lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse from August.

Given the strength of the support level 42000.00 and the improvement in investor sentiment as seen across the global equity markets, Dow Jones index can be expected to rise to the next resistance level 43000.00.