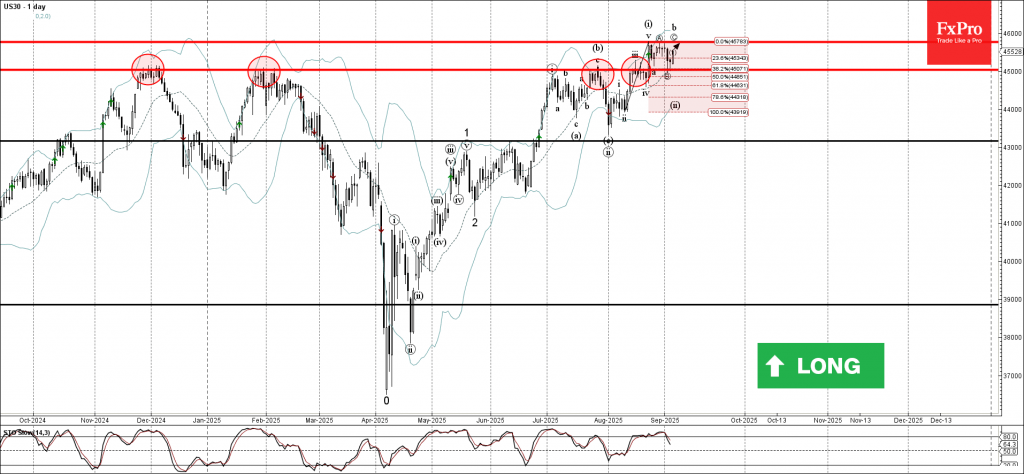

Dow Jones Index: ⬆️ Buy

– Dow Jones Index reversed from key support level 45000.00

– Likely to rise to resistance level 45765.00

Dow Jones Index recently reversed from the support area between the key support level 45000.00 (former strong resistance, which has been reversing the price from the end of 2024), 20-day moving average and the 38.2% Fibonacci correction of the upward impulse from August.

The upward reversal from this support area stopped the previous short-term correction ii.

Given the strong daily uptrend, Dow Jones Index can be expected to rise to the next resistance level 45765.00 (which reversed the Index in August).