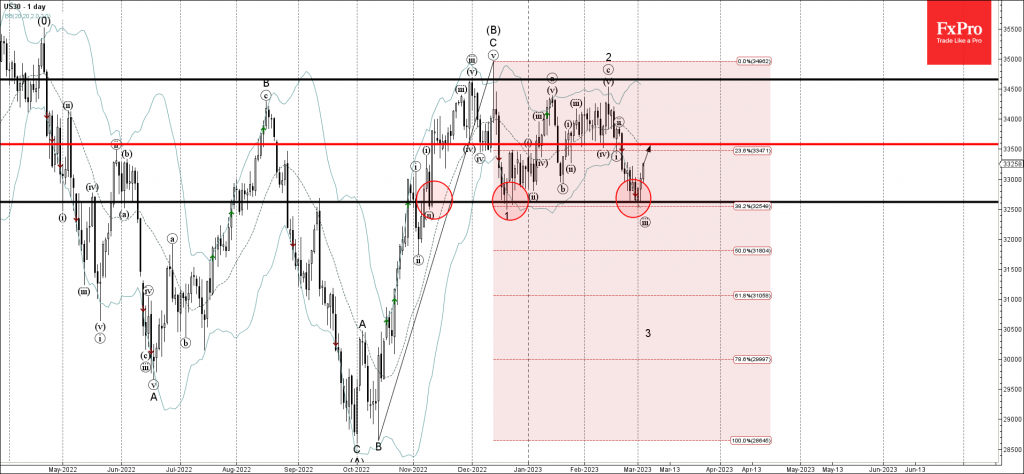

• Dow Jones index reversed from key support level 32620.00

• Likely to rise to resistance level 33585.00

Dow Jones index recently reversed up from the key support level 32620.00 (which has been reversing the price from the start of November) strengthened by the lower daily Bollinger Band and by the 38.2.% Fibonacci correction of the sharp upward impulse from October.

The upward reversal from the support level 32620.00 created the daily Japanese candlesticks pattern Bullish Engulfing.

Dow Jones index can be expected to rise to the next resistance level 33585.00 (former support from the start of February).