– Dow Jones index broke key support level 34000.00

– Likely to fall to support level 33500.00

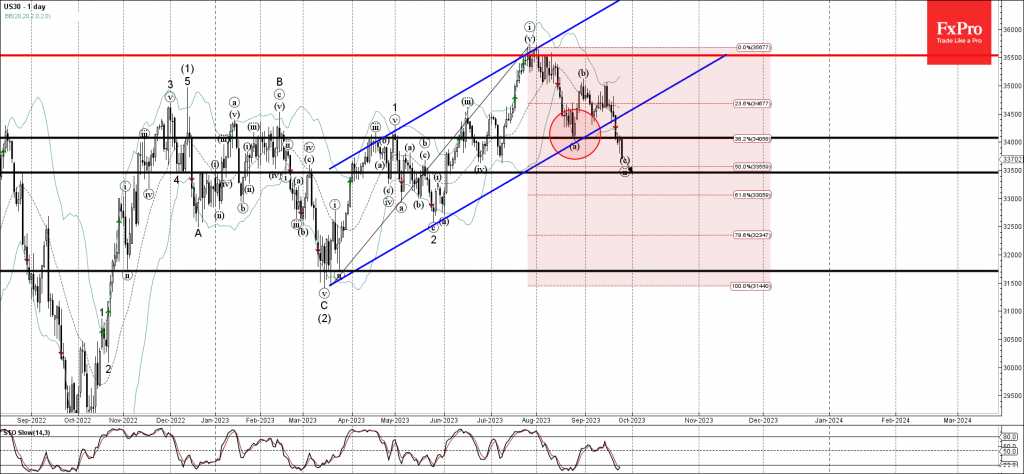

Dow Jones index recently broke key support level 34000.00 (low of the previous wave a) intersecting with the 38.2% Fibonacci correction of the previous upward impulse from March.

The breakout of the support level 34000.00 was preceded by the breakout of the daily up channel from March – which accelerated the active wave ii.

Dow Jones index can be expected to fall further toward the next support level 33500.00, target for the completion of the active wave ii.