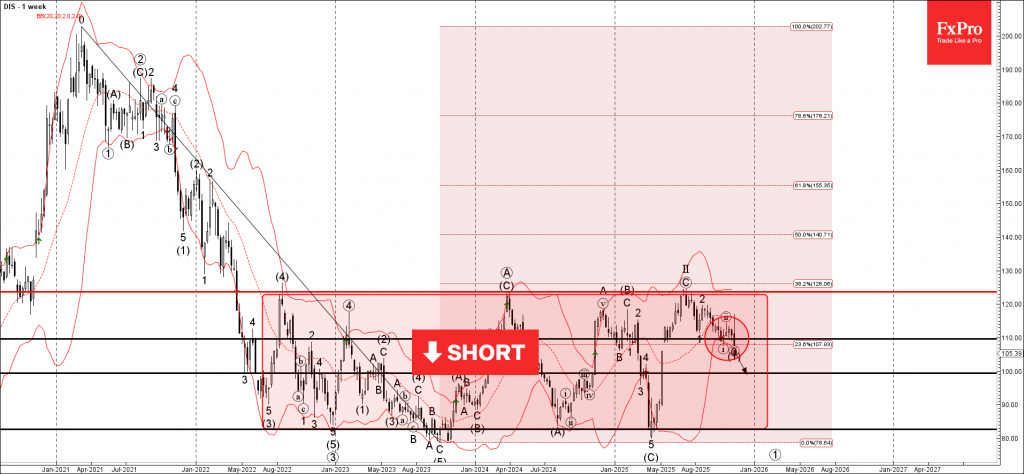

Disney: ⬇️ Sell

– Disney falling inside impulse wave (1)

– Likely to fall to support level 100.00

Disney continues to fall inside the wide weekly sideways price range from the middle of 2022, as can be seen from the weekly Disney chart below.

The price earlier broke below the support level 110.00 (which stopped the previous impulse wave i) – which accelerated the active impulse wave (1).

Given the long-term downtrend, Disney can be expected to fall further in the active impulse wave (1) to the next round support level 100.00.