– Disney broke resistance level 90.50

– Likely to rise to resistance level 94.10

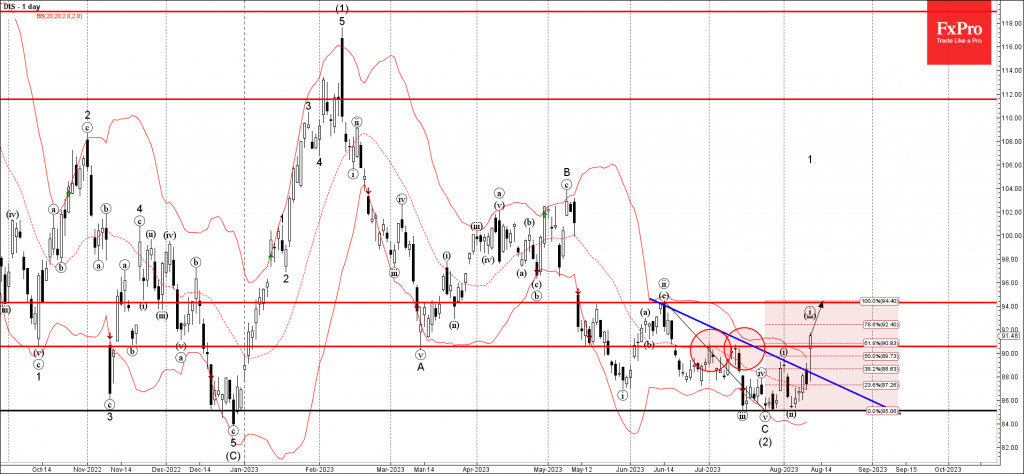

Disney recently broke the resistance level 90.50 (which has been reversing the price from the end of June) after the price broke the resistance trendline from June.

The breakout of the resistance level 90.50 coincided with the breakout of the 61.8% Fibonacci correction of the downward impulse from June – which accelerated the active impulse wave i.

Disney can be expected to rise further toward the next resistance level 94.10 (former monthly high from June, target for the completion of the active impulse wave i).