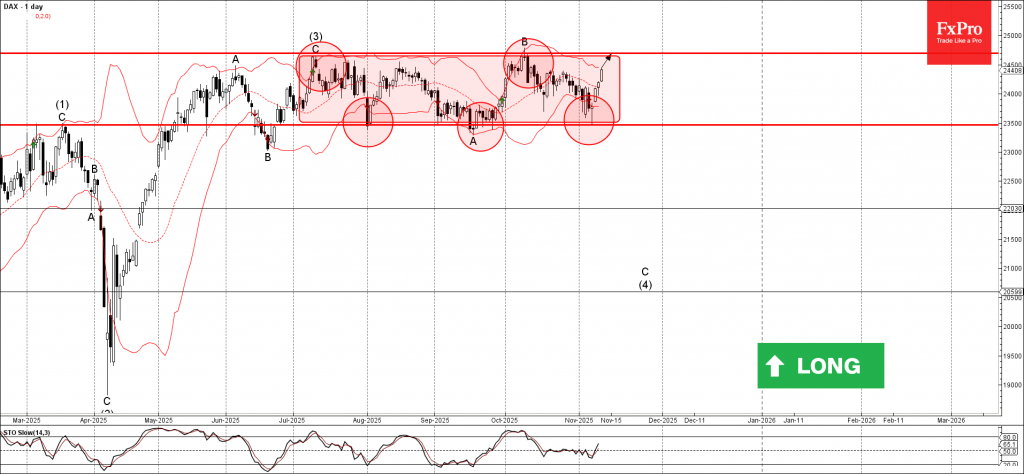

DAX index: ⬆️ Buy

– DAX index reversed from support level 23500.00

– Likely to rise to resistance level 24695.00

DAX index recently reversed with the daily Hammer from the support level 23500.00 (lower border of the sideways price range inside which the index has been moving from July, as can be seen from the daily DAX chart below).

The support level 23500.00 was strengthened by the lower daily Bollinger Band.

Given the clear daily uptrend, DAX index can be expected to rise further to the next resistance level 24695.00 (upper border of the active sideways price range, which stopped earlier waves (3) and B).