Market Overview

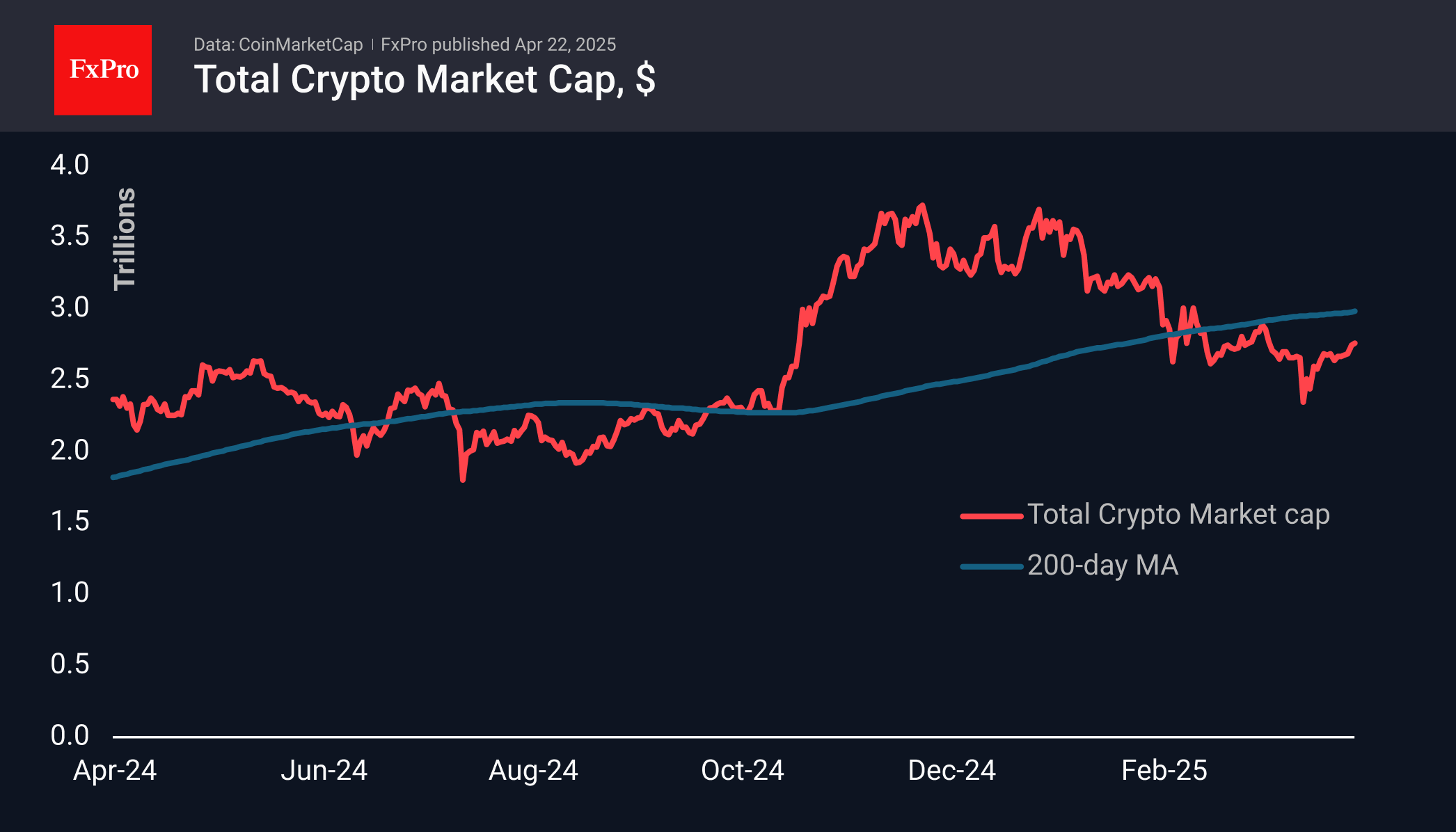

The crypto market has gained around 2% over the past seven days, with most of the increase coming at the start of this week. With a market capitalisation of $2.76 trillion, the crypto market has reached the upper boundary of its April range. For now, it can be noted that the market managed to find support at the key $2.45 trillion level—a former resistance zone last year that became the launchpad for the rally starting in November.

Sentiment is also recovering, with the relevant index rising to 47, matching the highs of 27 March. This marks a promising move from the fear zone into neutral territory. Such shifts are often followed by continued market strength after a pullback.

On Monday, Bitcoin rose to nearly one-month highs above $88,000, despite a decline in equity indices. BTC climbed amid a weakening dollar and gold reaching a new all-time high. The leading cryptocurrency is now testing the 200-day moving average after a prolonged struggle around the 50-day average. A breakout above this level could lead to acceleration.

News Background

Bitget Research notes that the weakening dollar and increasing correlation with gold enhance Bitcoin’s appeal as an inflation hedge and a safe-haven asset.

According to Glassnode, the number of wallets holding more than 1,000 BTC has reached a four-month high in recent months. The metric has returned to levels seen in November–December 2024, when the market was rallying following Donald Trump’s election as US President.

BitMEX co-founder Arthur Hayes stated that this may be the last opportunity to buy BTC below $100,000. In his view, the key growth driver will be the US Treasury’s buyback of government bonds, which injects additional liquidity into the market.

The FxPro Analyst Team