Market picture

The crypto market lost 1.8% over the past 24 hours to $1.120 trillion, returning to Monday’s levels. The growth momentum of the previous day was not supported by the new portion of bad news about the debt ceiling, which launched a pull from risky assets.

Over the past 24 hours, Bitcoin has lost 2.2%, Ethereum 2%, and the top altcoins have lost between 1% (XRP) and 5.8% (Litecoin).

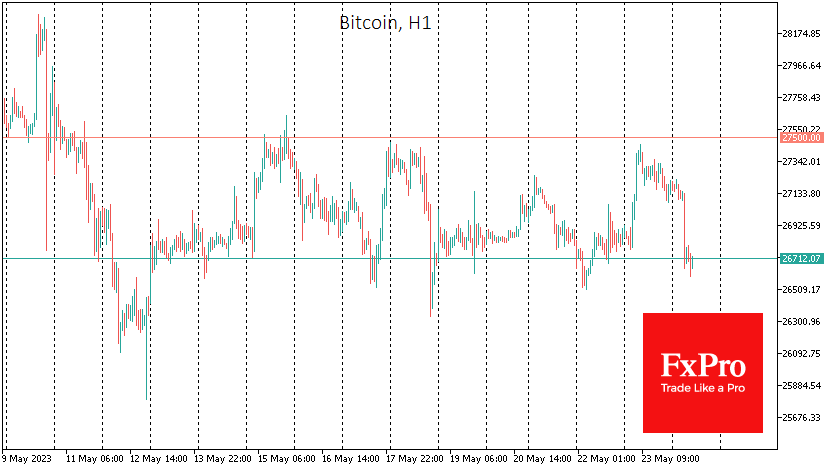

Bitcoin is trading near $26650 on Wednesday morning, near the lower end of its trading range since May 13. The upper boundary of this corridor, 27300, remains a significant upside hurdle. A simple scenario codenamed “what doesn’t go up, goes down” could soon come to fruition in Bitcoin. Also on the bears’ side is that the former cryptocurrency is under the 50-day moving average, settling there long enough after the failure, and now former support works as resistance.

BTC volatility has fallen to a five-month low. Last week, the narrow range of BTC quotations coincided with a meagre volume of transferred on-chain value. Most of the coins are “napping” in anticipation of higher prices.

News background

Since 13 April, following the activation of the Shapella hardfork on the Ethereum network, the volume of ETH in stacks has increased by 4.4 million coins. In total, 22.5 million ETH, or approximately 18% of the total supply, have been staked on the blockchain.

Strike, a Lightning Network-based payment application operator, announced the integration of the Tether (USDT) into its platform.

Bloomberg reports that the Hong Kong Securities and Futures Commission (SFC) will officially allow retail investors to trade cryptos from June 2023.

According to The Block, the share of trading volume on decentralised exchanges (DEX) has reached a record high, surpassing 22% for the first time amid the popularity of meme cryptocurrencies. Users are not waiting for them to be listed on centralised exchanges (CEXs) but are switching to DEXs to buy meme tokens.

Government authorities could use the courts to demand access to funds in Ledger wallets connected to Recover’s private key recovery service, the hardware cryptocurrency wallet maker confirmed but called such a scenario unlikely.

The FxPro Analyst Team