Market Overview

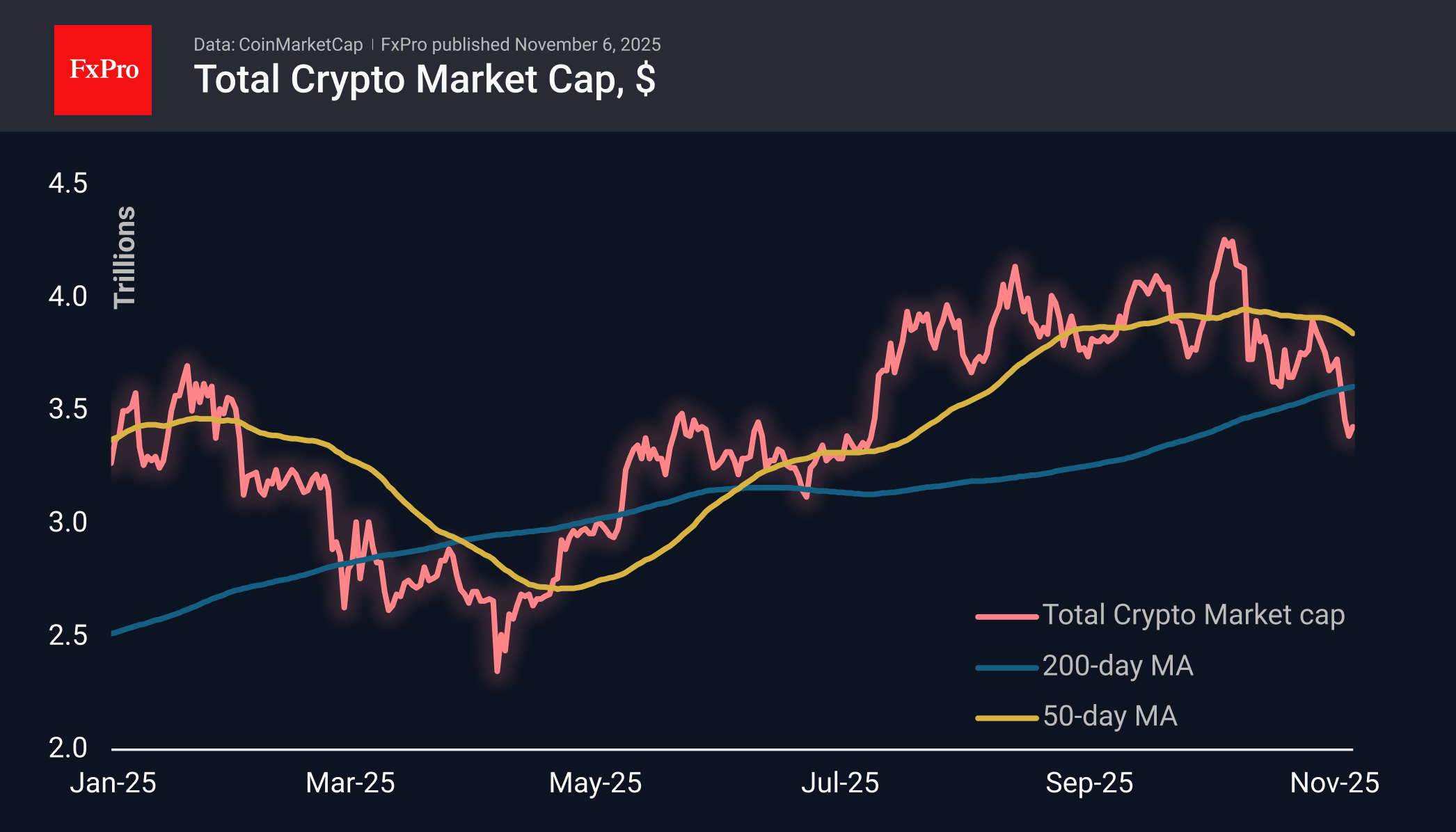

The crypto market has gained 1% over the past 24 hours, the first increase after four days of decline. The market is stabilising at levels just above $3.4 trillion, close to May’s local highs. The situation currently resembles a pause in the decline rather than a serious reversal, due to somewhat cautious sentiment in the stock markets and the strengthening of the dollar since the second half of September. Ironically, this reversal coincides with the resumption of the easing cycle of monetary policy.

The sentiment index has emerged from the zone of extreme fear, which also coincided with a market rebound. According to the creators of such an index, now is the right time for bulls. Still, traders should be cautious with such an interpretation, as the previous rebound from extreme fear was not long-lasting, and the market is now 5% below the local low of 17 October, when sentiment last recovered from extreme anxiety.

Bitcoin is trading near $ 103,000, pausing its rebound but remaining far from its recent lows. The bulls managed to bring the coin back above the 50-week moving average, but there is still a lot of time left until the end of the week, and for now, time is on the bears’ side. On intraday charts, it looks as if the rebound has run out of steam and sellers are ready to seize the initiative again.

News Background

Cryptocurrencies are under pressure from general risk aversion in global markets. Among the factors are concerns about the Fed’s interest rate and the situation in the credit sector, according to Hashdex. Wintermute attributes the worst performance of cryptocurrencies among all other asset classes to the redistribution of cash flows to other markets.

Short-term Bitcoin holders continue to sell cryptocurrencies at a loss, using any rebound as an opportunity to sell, notes analyst Darkfost. However, accumulator addresses — wallets that only buy and never sell — have acquired a record 375,000 BTC over the past month.

Amid the asset’s decline, French company Sequans Communications, which accumulates Bitcoin, was forced to sell 970 BTC to partially repay its convertible debt. The company’s reserves fell from 3,234 to 2,264 BTC.

Japanese company Metaplanet, on the other hand, is raising funds to purchase bitcoins. On 31 October, the company received a $100 million loan secured by its reserves.

Ripple announced that it had raised $500 million in strategic investments (with a valuation of $40 billion) from major institutional players.

Zcash (ZEC) could become an alternative to Bitcoin among those who fear the centralisation of BTC due to Wall Street and are concerned about the tracking of on-chain transactions, according to Galaxy Digital. Supporters of the private coin refer to it as ‘encrypted Bitcoin’ and a return to the principles of the cypherpunks.

The FxPro Analyst Team