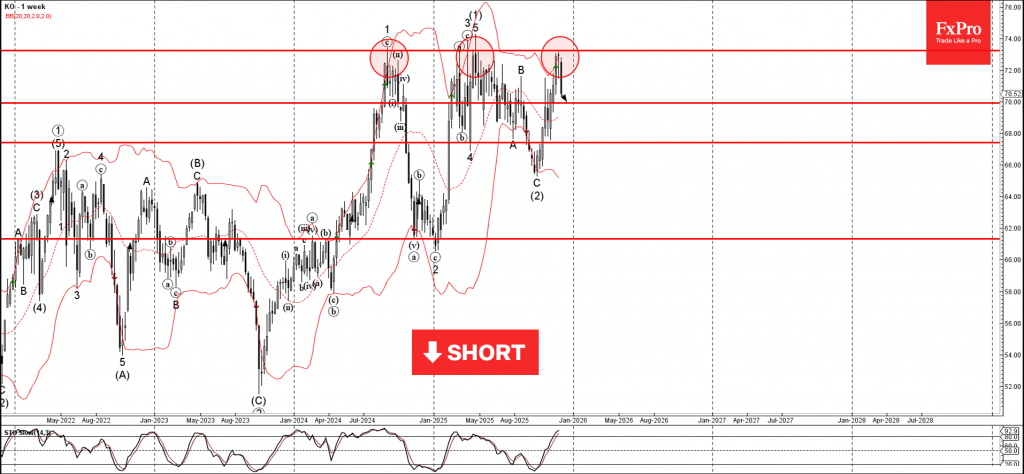

Coca-Cola: ⬇️ Sell

– Coca-Cola reversed from long-term resistance level 73.25

– Likely to fall to support level 70.00

Coca-Cola recently reversed from the resistance zone between the powerful long-term resistance level 73.25 (which has been reversing the price from the middle of 2024) and the upper weekly Bollinger Band.

The downward reversal from this resistance zone is likely to form the weekly Japanese candlesticks reversal pattern Evening Star Doji – if the price closes this week near the current levels.

Given the strength of the resistance level 73.25 and the overbought weekly Stochastic, Coca-Cola can be expected to fall to the next support level 70.00.