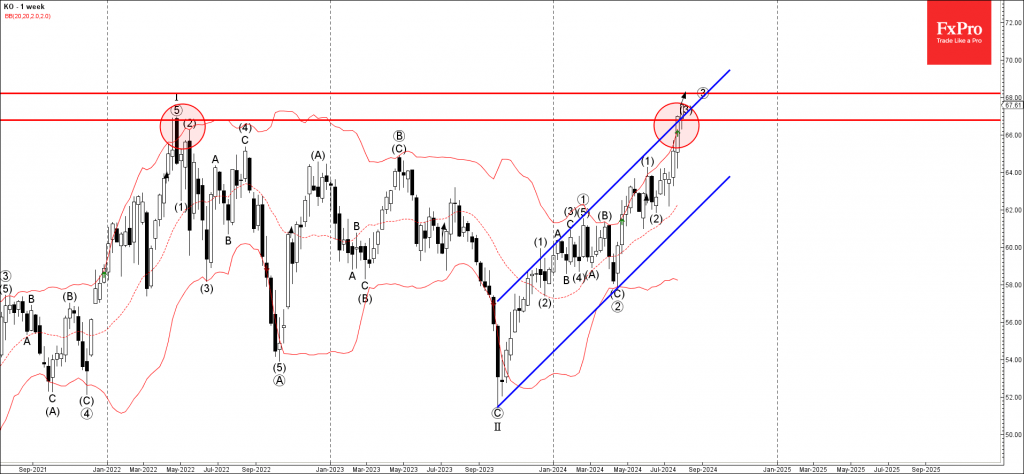

– Coca-Cola broke long-term resistance level 66.80

– Likely to rise to resistance level 68.00

Coca-Cola continues to rise strongly after the earlier breakout of the of long-term resistance level 66.80, which stopped the weekly uptrend at the start of 2022.

The breakout of the resistance level 66.80 coincided with the breakout of the weekly up channel from 2023 – which accelerated the active weekly impulse wave (3).

Given the clear weekly uptrend, Coca-Cola can be expected to rise further to the next resistance level 68.00. Strong support now stands at the support level 66.80.