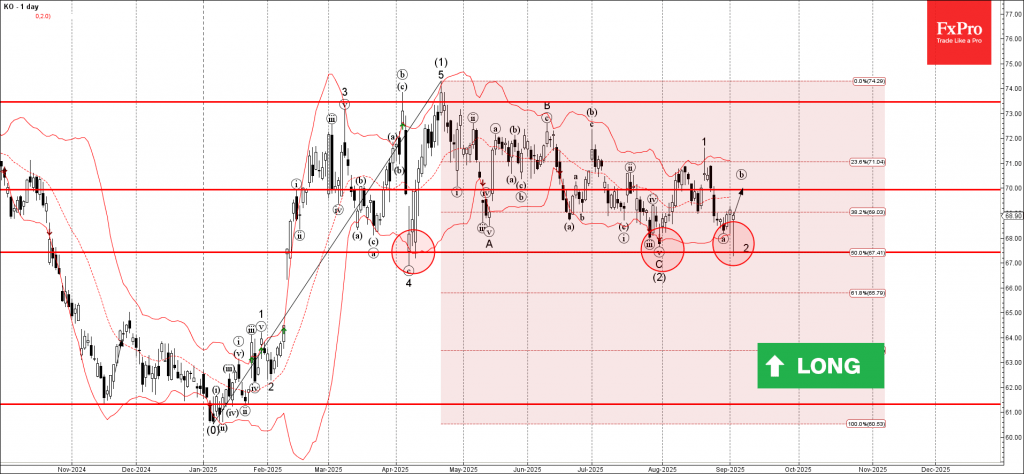

Coca-Cola: ⬆️ Buy

– Coca-Cola reversed from the support area

– Likely to rise to resistance level 70.00

Coca-Cola recently reversed from the support area between the strong support level 67.45 (which has been reversing the price from April), lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse (1) from January.

The upward reversal from this support area created the daily Japanese candlesticks reversal pattern Hammer, which stopped earlier wave a.

Coca-Cola can be expected to rise to the next resistance level 70.00, target price for the completion of the active wave b.