- Coca-Cola reversed from round support level 70.00

- Likely to rise to resistance level 72.45

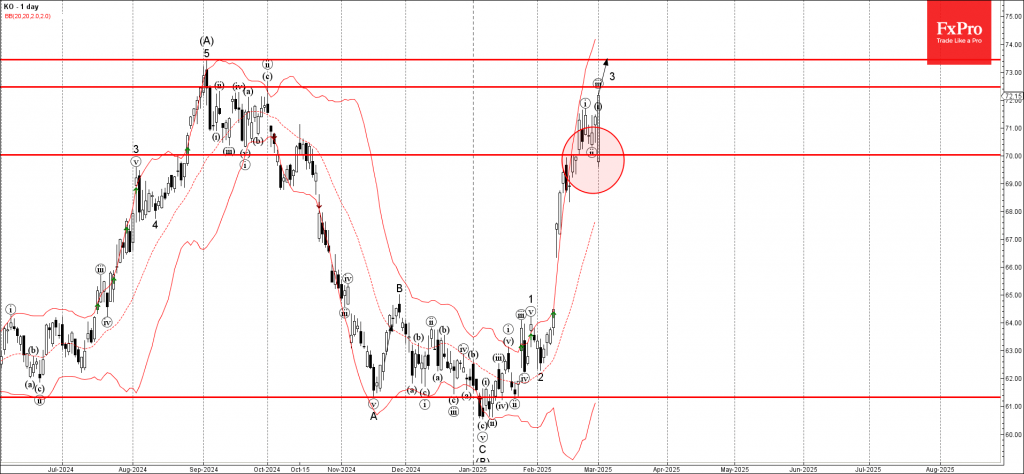

Coca-Cola recently reversed up sharply from the round support level 70.00, former resistance from October.

The upward reversal from the support level 70.00 continues the active short-term impulse wave 3 of the sharp impulse wave (3) from January.

Coca-Cola can be expected to rise to the next resistance level 72.45 (top of the Shooting Star from October) – followed by the resistance level 73.45 (multi-month high from last September).