– Coca-Cola reversed from support zone

– Likely to rise to resistance level 61.30

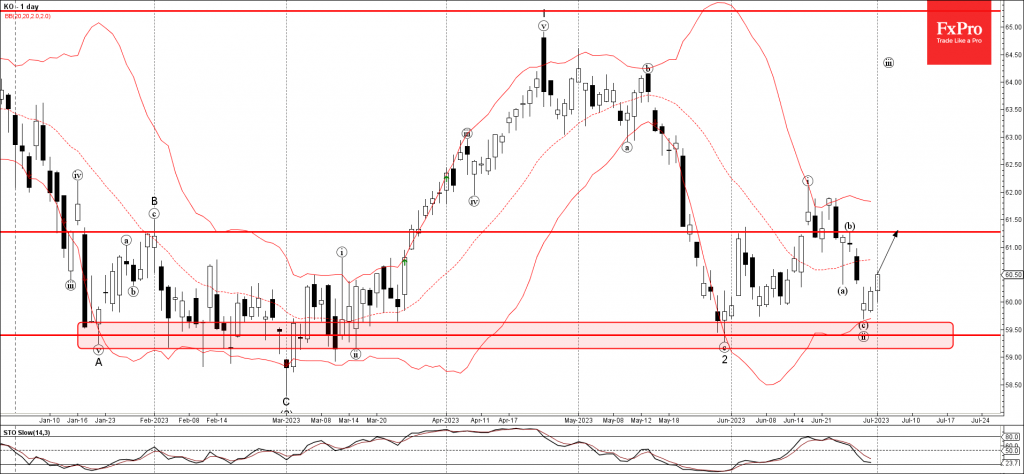

Coca-Cola recently reversed up from the support zone surrounding the strong support level 59.50 (which has stopped multiple waves from January) strengthened by the lower daily Bollinger Band.

The upward reversal from the support level 59.50 started the active short-term impulse wave (iii).

Given the strength of the support level 59.50, Coca-Cola can be expected to rise further toward the next resistance level 61.30 (top of the previous minor correction (b) from June).