- Coca-Cola reversed from support level 61.35

- Likely to rise to resistance level 64.00

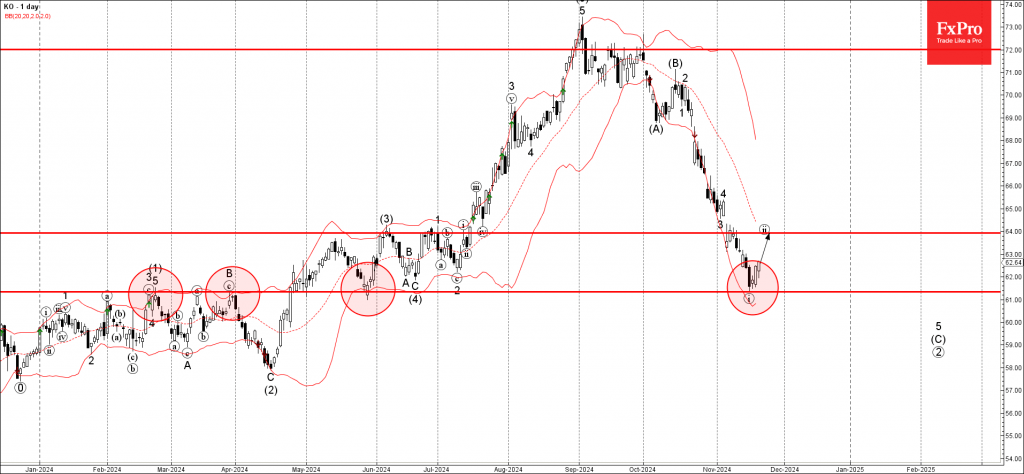

Coca-Cola earlier reversed up from the support zone between the pivotal support level 61.35 (former monthly high from February and March) and the lower daily Bollinger Band.

The upward reversal from this support zone created the daily Japanese candlesticks reversal pattern Morning Star, which started the active minor ABC correction (ii).

Coca-Cola can be expected to rise to the next resistance level 64.00, which is the target price for the completion of the active wave ii.